13th Month Pay Guidelines

The request for exemption and deferment of payment would not be accepted despite. Perceivable Operable Understandable and Robust POUR for short.

How To Compute The 13th Month Pay Payrollhero Support

The first installment is paid at the beginning of the school year while the second installment is paid out not later than 24th of December of every year.

13th month pay guidelines. The minimum 13th month pay required by law shall not be less than one-twelfth of the total basic salary earned by an employee within a calendar year. President Marcos put it in place to compensate for the low minimum wage rates considering Congress had failed to update them since 1970. The minimum 13th month pay required by.

On 19 October 2020 the Guidelines on the Payment of 13th Month Pay was indicated in the Labor Advisory No. DOLE Guidelines for 13th Month Pay in Private Sectors 1. Why should I receive a 13th month pay.

28 series of 2020 Guidelines on the Payment of Thirteenth Month Pay Advisory providing as follows. For the year 1987 the computation of the 13th month pay shall include the cost of living allowances COLA integrated into the basic salary of a covered employee pursuant to Executive Order 178. Total basic salary earned during the year 12 months Proportionate 13th Month Pay Value.

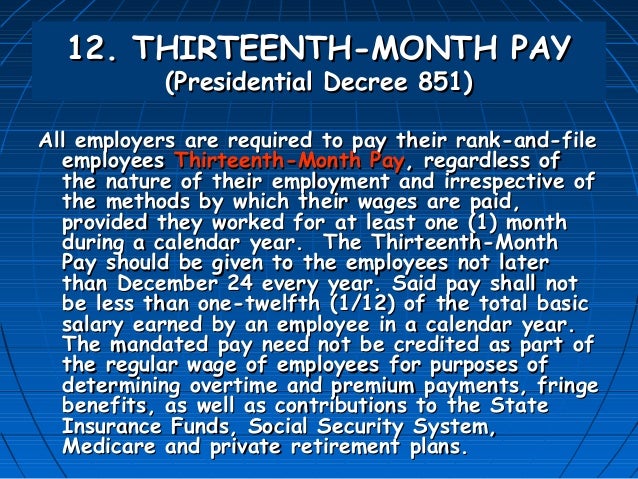

851 employers from the private sector in the Philippines are required to pay their rank-and-file employees a Thirteenth 13th Month Pay not later than December 24 every year. Definition of Rank-and-File Employees. The 13th month pay is equivalent to one twelfth 112 of an employees basic annual salary.

WCAG 20 is also an international standard ISO 40500. Under Presidential Decree No. 2 SERIES OF 1976.

The minimum 13th month pay required by law shall not be less than one-twelfth 112 of the total basic salary earned by an employee within a calendar year. In most countries in Latin American the 13th-month salaries usually are paid out in two equal installments. Total basic salary earned during the year proportionate 13th month pay.

Labor Advisory on 13th Month Pay Guidelines for Year 2020 PDF. All employers are required to pay their rank and file employees thirteenth-month pay regardless of the. There are testable success criteria for each guideline.

It is a single annual payment on top of an employees total annual wage. WCAG 20 contains 12 guidelines organized under 4 principles. The Advisory provides that all rank-and-file employees in the private sector will be entitled to 13th month pay regardless of their position designation or.

Payment depends on what is in your employment contract or collective agreement. An employer however may give to his employees one-half of the 13 th month pay before the opening of the regular school year and the other half on or before the 24 th day of December of every year. Who are entitled to 13th month pay.

It should be paid not later than December 24 of each year. The minimum 13th month pay required by law shall not be less than one-twelfth of the total basic salary earned by an employee within a calendar year. The Department of Labor and Employment DOLE recently issued Labor Advisory No.

AWS is not compulsory. By Atty ElvinLabor LawLabor Advisory0 Comments. 851 ADMINISTRATIVE ORDER NO.

Amount of 13th month pay The minimum 1 month pay required by law shall not be less than one-twelfth 112 of the total basic salary earned by an employee within a calendar year. The law dictates that you should get a monetary benefit in a form of 13th month pay not later later than December 24. 1976 PRESIDENTIAL DECREE NO.

Labor Advisory 28 Series of 2020 was issued on October 16 2020 providing guidelines for the payment of the 13th month pay. As set by the Department of Labor and Employment DOLE you should receive your 13th month not later than December 24 of every year. The 13th-Month Pay Law Presidential Decree No.

28 Series of 2020 Labor Advisory No. 851 The 13th-Month Pay Law - Implementing Rules. This certifies it as a stable and referenceable technical standard.

For the year 1987 the computation of the 13th month pay shall include the cost of living allowances COLA integrated into the basic salary of a covered employee pursuant to Executive Order 178. When will I receive my 13th month pay. Rank-and-file employees in the private sector shall be entitled to 13th month pay regardless of their.

851 Section 1 states that. Amount of the 13th Month Pay. Amount of 13 th Month Pay.

The 13th-month pay law was originally created in December of 1975 by Philippine President Ferdinand Marcos. When should the 13 th month pay be paid. The computation formula is as follows.

The minimum 13th Month Pay payment under law must not be less than 112 of an employees total basic salary earned during 2020. The 13th-Month Pay Law - Supplementary Rules. THE 13th-MONTH PAY LAW.

The 13th-Month Pay Law - Guidelines Administrative Order No. The AWS is also called the 13th month payment. For example it paid between September and December in Chile.

DOLE Advisory Guidelines on the Payment of 13th Month Pay 2020 PDF Copy of the DOLE Guidelines on 13th Month Pay. The law is also referred to as Presidential Decree No. This makes it mandatory for employers to give 13th month pay to all their rank-and file employees.

28 issued the the Department of Labor and Employment DOLE. The Labor Code as amended distinguishes a rank.

What Is 13th Or 14th Month Pay And How Do I Calculate It

Labor Laws Governing Cooperatives

Difference National Wages And Productivity Commission Facebook

Hiring Remote Workers In The Philippines A Guide For Us Employers

A Quick Guide To 13th Month Pay Updated For 2018 13th Month Pay Solutions Payroll Software

How To Compute 13th Month Pay 13th Month Pay Months Computer

Dole Guidelines For 13th Month Pay In Private Sectors

How To Compute The 13th Month Pay Payrollhero Support

Philippine Government U Turns On 13th Month Pay After Pressure From Unions Industriall

Back Pay Computation And Guide For Working Filipinos

13th Month Pay In The Philippines Computation And Guide

13th Month Pay Computation Dole Labor Advisory

A Quick Guide To 13th Month Pay 13th Month Pay Months Payroll Software

How To Compute 13th Month Pay In The Philippines An Ultimate Guide

13th Month Pay Computation Dole Labor Advisory

Dole Guidelines For 13th Month Pay In Private Sectors

13th Month Pay In The Philippines Computation And Guide

How To Compute 13th Month Pay In The Philippines An Ultimate Guide

Post a Comment for "13th Month Pay Guidelines"