Monthly Salary Calculator With Tax Code

For an estimate of your take-home pay please fill in your salary below. As this tax calculator is based upon annual calculations it is.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Payroll Taxes

How to use the Take-Home Calculator.

Monthly salary calculator with tax code. This calculator allows you to enter you monthly income for each month throughout the tax year. The calculator then provides monthly PAYE and NI deductions and an annual figure overview of deductions so you can review monthly amounts and annual averages for standard payroll deductions. Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator.

Change to Previous Tax Year. The tax calculator can be used as a simple salary calculator by entering your Monthly earnings choosing a State and clicking calculate. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Income and Assessment Year. Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. We offer you the chance to provide a gross or net salary for your calculations.

This is because should a tax code change for any reason it. Hourly rates weekly pay and bonuses are also catered for. 27500 of your earnings qualify to be taxed at 20.

Tax codes accepted at the moment are L P T V Y and BR D0 D1 NT 0T and K. Subtract your total deductions to your monthly salary the result will be your taxable income. Tax Code 1257L is the most common tax code.

810L 747L 429P BR D1 etc. The Monthly Tax Calculator uses the 2019 Income Tax Slabs. When youre done click on the Calculate button and the table on the right will display the information you requested from the tax calculator.

By default the 2021 22 tax year is applied but if you wish to see salary calculations for other years choose from the drop-down. From your payslip enter the total gross income to date in this tax year. Its so easy to use.

Why not find your dream salary too. Use the Monthly Tax Calculator to calculate your salary and tax for 202122 assessment year. This will give you 1042 per month of tax free earnings.

You will pay 0 tax at the additional tax. Taxable Income Monthly Salary - Total Deductions 25000 - 1600 23400 Base on our sample computation if you are earning 25000month your taxable income would be 23400. Pay will be calculated using the rules for Pay as You Earn meaning taxes are worked out cumulatively so are reliant upon the amount of income taxation and allowance up to each pay period within the tax year.

To use the tax calculator enter your annual salary or the one you would like in the salary box above. Enter your tax code. Our salary calculator will provide you with an illustration of the costs associated with each employee.

Our online salary tax calculator is in line with changes announced in the 20212022 Budget Speech. It needs to be the full code ie. You will pay 0 tax at the higher tax rate of 40.

You can find further details on using the advanced calculator features by reviewing the instructions below the calculator and supporting finance guides. Social Security and Medicare. For example if you have tax codes 300L and 250L the tax-free allowance given to you by your tax codes is 5500.

If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. This calculator assumes youre employed as self-employed national insurance rates are different. We strongly recommend you agree to a gross salary rather than a net salary.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. This is only a ready reckoner that makes standard assumptions to estimate your tax breakdown. Add up the personal allowances given to you by your tax codes.

People who are employed will have a tax code and deductions are made before they receive their regular salary. Enter the number of hours and the rate at which. You will see the costs to you as an employer including tax NI and pension contributions.

If you enter the bonus as a percentage of the CTC the calculator will calculate the performance bonus as a percentage of the cost to the company. This is great for comparing salaries reviewing how much extra you will have after a pay rise or simply keeping a quick eye on your tax withholdings. Calculate how tax changes will affect your pocket.

Quick Pay Calculator for 202122. If these arent equal to the allowance that your age and salary predict for you the calculator. It is important to understand that National Insurance is calculated on the period you are paid.

Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax. UK Tax Salary Calculator. You can now choose the tax year that you wish to calculate.

Find out the benefit of that overtime. So in this calculator. From your payslip enter the total tax deducted to date in this tax year.

There are many other possible variables for a definitive source check your tax code and speak to the tax office. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. 0 of your earnings qualify to be taxed at 40.

The latest budget information from April 2021 is used to show you exactly what you need to know. Youll be able to see the gross salary taxable amount tax national insurance and. Per year per month per week.

You will pay 5500 tax at the basic tax rate of 20. The ClearTax Salary Calculator calculates the take-home salary based on whether the bonus is a fixed amount or a percentage of the CTC.

Salary Income Tax Calculation In Ethiopia Pension Gross Salary And Net Salary Calculator With Examples Addisbiz Com

Income Tax Calculator Calculate Your Income Tax Online In India

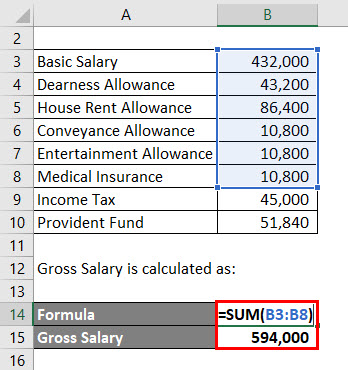

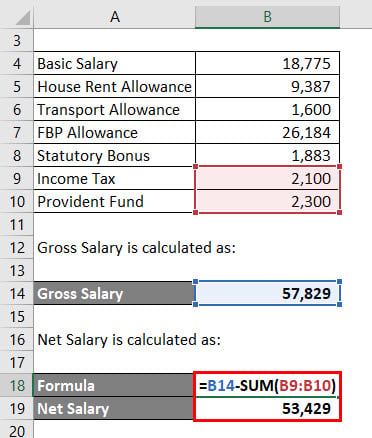

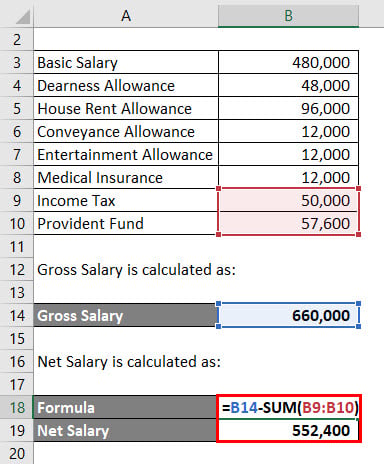

Salary Formula Calculate Salary Calculator Excel Template

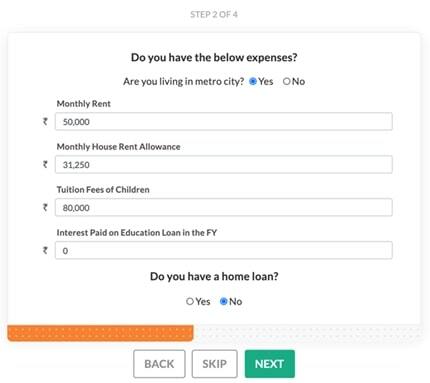

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

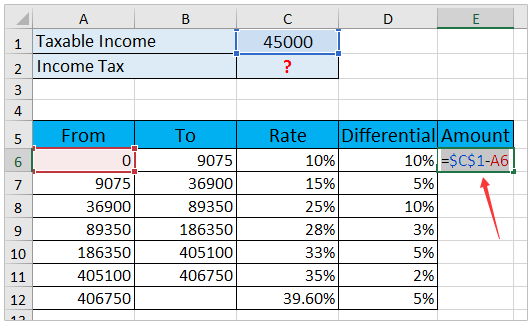

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Salary Formula Calculate Salary Calculator Excel Template

Salary Calculator 2020 21 Take Home Salary Calculator India

Income Tax Co Uk Uk Tax Calculator Home Facebook

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

How To Calculate Income Tax In Excel

25 000 After Tax 2021 Income Tax Uk

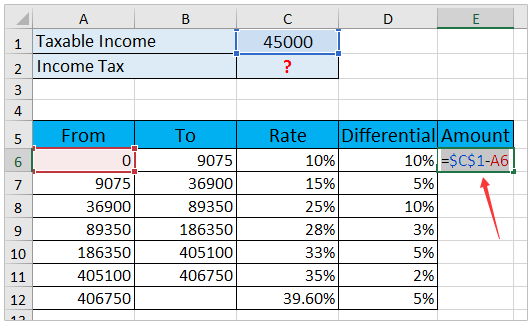

Excel Formula Income Tax Bracket Calculation Exceljet

Salary Formula Calculate Salary Calculator Excel Template

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate Income Tax Slab Rate For Individuals Basics Of Inco

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Post a Comment for "Monthly Salary Calculator With Tax Code"