Monthly Salary Calculator Bonus

To use the tax calculator enter your annual salary or the one you would like in the salary box above. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Bonus For Bank Employees Check Eligibility Guidelines Examples Illustrations Oneindia News

Similar calculations will be done by your employer if you are paid weekly.

Monthly salary calculator bonus. All you need to do is enter your regular salary details and then enter the amount of the bonus. If you are receiving monthly bonuses simply add them together to come up with the yearly figure. The figure is bonus payable to employee under the act.

Its so easy to use. The types supported by our calculator are Auto-enrollment Personal Salary Sacrifice and Employer. Previously the maximum bonus payable was 20 of Rs 3500 per month.

Please see the table below for a more detailed break-down. For example for 5 hours a month. The calculator assumes the bonus is a one-off amount within the tax year you select.

Hourly rates weekly pay and bonuses are also catered for. Youll pay 6500 in tax 4260 in National Insurance and your yearly take-home will be 34240. Our online salary tax calculator is in line with changes announced in the 20212022 Budget Speech.

The Konnekt salary and tax calculator is a new simple tool that gives you a comprehensive overview of your salary while employed in Malta. If monthly salary is RM 5000 with a. Here we put together a tool for you to automatically prorate.

For the purposes of displaying the information The Salary Calculator assumes that your salary is normally paid monthly and shows you what a bonus month would look like compared to a normal month. The latest budget information from April 2021 is used to show you exactly what you need to know. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage.

Payments are made at the end of June and December and will be included in your payslips. The minimum bonus payment was capped at 833 of Rs 3500 per month or Rs 100 whichever is higher. If there is any change in monthly Basic Salary or DA amount or in Minimum Wage amount or in monthly payable days then you can make changes in below tables to derive correct Annual Statutory Bonus amount by clicking on Recalculate button 1.

It takes into account a number of factors such as tax rates in Malta Social Security SSCNI contributions and government bonuses. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. FB retail professional services.

1 The Statutory Bonus of 13510 is paid every six months and equates to 074 per calendar day including Saturdays and Sundays on a pro-rata basis. The maximum qualified Bouns wage is restricted to the applicable State Minimum Wage Act rate. If you wish to ONLY calculate the PCB for bonus of an employee with monthly salary you will still need to enter the monthly salary of the employee even if the bonus is paid at a different date.

Why not find your dream salary too. Singapore Prorated Salary Salary for Incomplete Month of Work Calculator This calculator which calculates salary for incomplete month of work is catered to employers and employees of all industries including service industries eg. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

All bi-weekly semi-monthly monthly and quarterly figures. Similar calculations will be done by your employer if you are paid weekly. This will calculate the combined tax for both salary and bonus in the payslip after that you may deduct the tax of the monthly salary component to get the bonus-only tax.

Click here - Bonus Act and online Bonus Calculator. For the purposes of displaying the information The Salary Calculator assumes that your salary is normally paid monthly and shows you what a bonus month would look like compared to a normal month. The adjusted annual salary can be calculated as.

Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. If you have other deductions such as student loans you can set those by using the more options button. If you have a yearly bonus payment you can also add that to your annual salary and well include it in the calculations.

Simply enter your current monthly salary and allowances to view. The results are broken down into yearly monthly weekly daily and hourly wages. 30 8 260 - 25 56400.

At Talenox we believe in designing HR experiences for people not personnel. For more details on Statutory Bonus Act. Attendance sheet with salary in excel format free download how to calculate bonus on salary in excel__LINKS_ Facebook.

To get started click here to check out. Calculate how tax changes will affect your pocket. Enter the number of hours and the rate at which you will get paid.

If your salary is 45000 a year youll take home 2853 every month. Your gross hourly rate will be 2163 if youre working 40 hours per week. Find out the benefit of that overtime.

This amount will be considered as employee income but if paid lumpsum as per act then tax-free but if this amount is paid along with monthly salary. 833 of Bonus Wage Basic DA amount. Bonus is to be calculated for eligible employees assuming salary Basic as Rs250000 per month or less if it is less then Rs250000 4Multiply the yearly sum of salary thus worked out as per above clause 3 with rate of bonus.

You can calculate your salary on a daily weekly or monthly basis. The Statutory Bonus amount is calculated based on the above amount entered by you.

Salary Formula Calculate Salary Calculator Excel Template

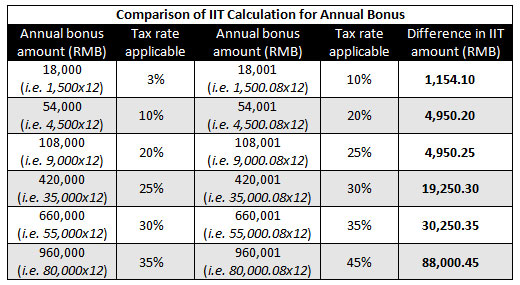

China Annual Bonus Tax Calculator Easier Cloud Accounting Business Megi

Bonus Calculation Format Excel Sheet 2018 With Formula

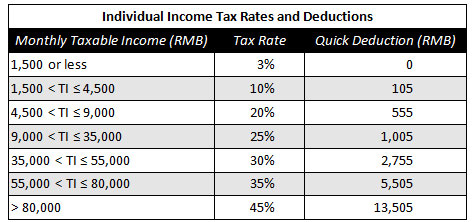

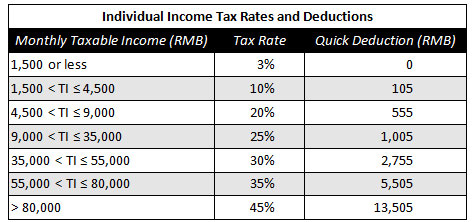

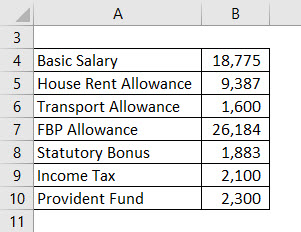

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

4 Ways To Calculate Annual Salary Wikihow

Malaysian Bonus Tax Calculations Mypf My

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

Payment Of Bonus Act Applicability And Calculations

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate Wage For Salary Calculator Singapore

China Annual Bonus Tax Calculator Easier Cloud Accounting Business Megi

Salary Formula Calculate Salary Calculator Excel Template

Salary Calculation Dna Hr Capital Sdn Bhd

Know Your Worth 7 Salary Calculators Tools To Compute Your Earnings

Malaysian Bonus Tax Calculations Mypf My

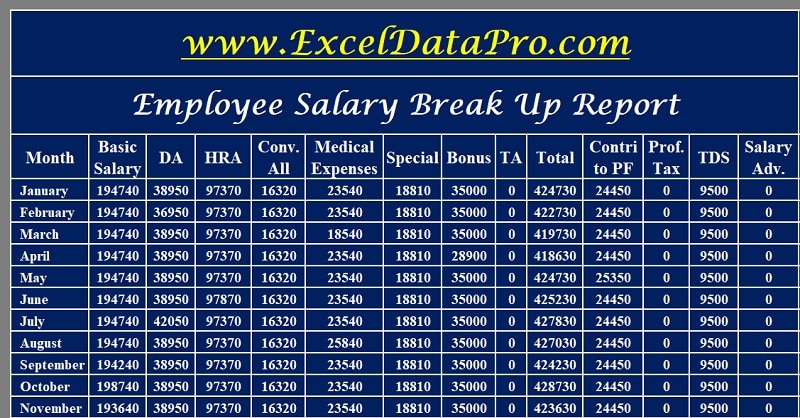

Download Salary Breakup Report Excel Template Exceldatapro

3 Ways To Do Bonus Pcb Calculation Without Payroll Software

Post a Comment for "Monthly Salary Calculator Bonus"