Ca Salary Paycheck Calculator

If you make 55000 a year living in the region of California USA you will be taxed 12070. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Washington Paycheck Calculator Smartasset

The State Controllers Office has updated.

Ca salary paycheck calculator. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Your average tax rate is 220 and your marginal tax rate is 397. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Can be used by salary earners self-employed or independent contractors. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488. The PaycheckCity salary calculator will do the calculating for you.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. That means that your net pay will be 40512 per year or 3376 per month. This California hourly paycheck calculator is perfect for those who are.

Enter your info to see your take home pay. Social Security and Medicare. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Important Note on Calculator. Salary Paycheck Calculator Calculate Net Income ADP. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

Why not find your dream salary too. If you have a job you receive your salary through the monthly bi-weekly or weekly payroll. California State Controllers Office.

That means that your net pay will be 42930 per year or 3577 per month. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. This marginal tax rate means that your immediate additional income will be taxed at this rate.

But do you know what is payroll and how is. SmartAssets California paycheck calculator shows your hourly and salary income after federal state and local taxes. Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator.

This number is the gross pay per pay period. Hourly rates weekly pay and bonuses are also catered for. It should not be relied upon to calculate exact taxes payroll or other financial data.

How to calculate taxes taken out of a paycheck. Canadian Payroll Calculator the easiest way to calculate your payroll taxes and estimate your after-tax salary. How are salary paychecks calculated.

It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. Free Paycheck Calculator to calculate net amount and payroll taxes from a gross paycheck amount. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution.

The latest budget information from April 2021 is used to show you exactly what you need to know. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Paycheck Calculator is a great payroll calculation tool that can be used to compare net pay amounts after payroll taxes in different states.

The California Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2021 and California State Income Tax Rates and Thresholds in 2021. Subtract any deductions and payroll taxes from the gross pay to get net pay. The Internal Revenue Service IRS redesigned the Form W-4 Employees Withholding Certificate to be used starting in 2020.

It also issued regulations updating the federal income tax withholding tables and computational procedures in Publication 15-T Federal Income Tax Withholding Methods. Refer to employee withholding certificates and current tax brackets to calculate federal income tax. California Paycheck Calculator Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Dont want to calculate this by hand. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Your average tax rate is 221 and your marginal tax rate is 349.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in California. California Hourly Paycheck Calculator.

California Paycheck Calculator Payroll check calculator is updated for payroll year 2021 and new W4. Overview of California Taxes California has the highest top marginal income tax rate in the country.

Paycheck Calculator Salaried Employees Primepay

Paycheck Calculator Take Home Pay Calculator

Texas Paycheck Calculator Smartasset

New Tax Law Take Home Pay Calculator For 75 000 Salary

California Overtime Law 2021 Clockify

2021 Salary Calculator Robert Half

Paycheck Taxes Federal State Local Withholding H R Block

How To Calculate Process Retroactive Pay

Ca Income Tax Calculator July 2021 Incomeaftertax Com

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Paycheck Calculator Take Home Pay Calculator

California Income Tax Calculator Smartasset Com Income Tax Property Tax Paycheck

Top 7 Free Payroll Calculators Timecamp

Free Online Paycheck Calculator Calculate Take Home Pay 2021

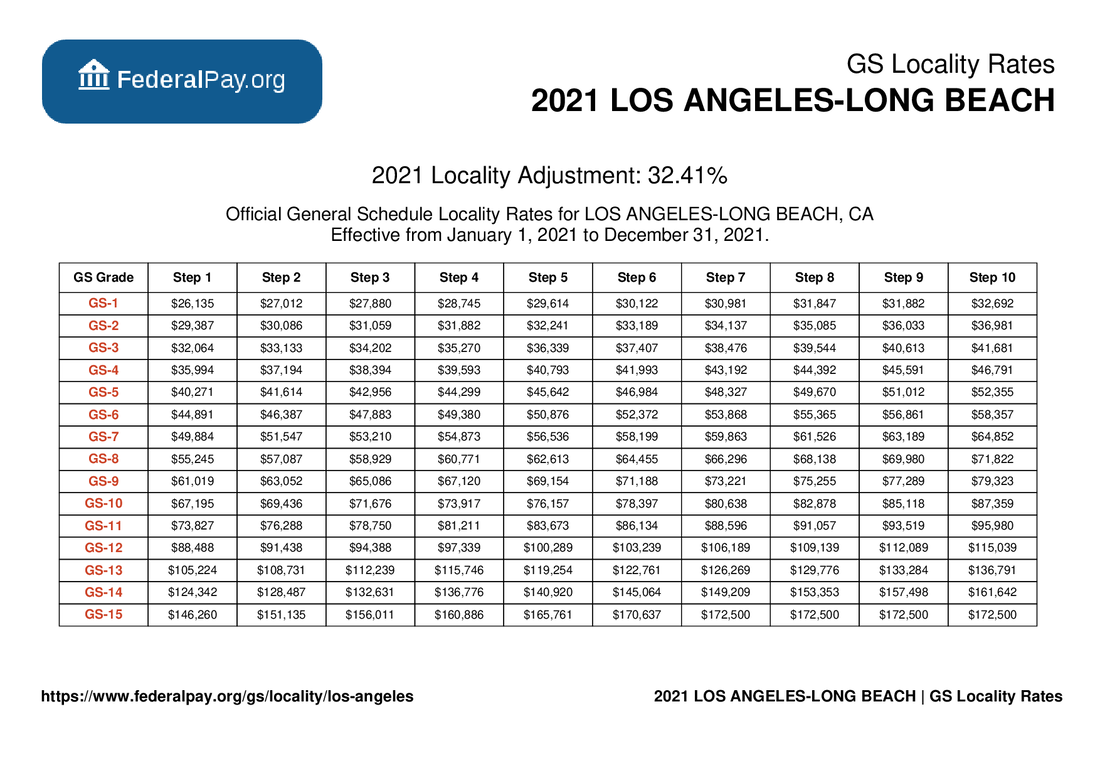

Los Angeles Pay Locality General Schedule Pay Areas

California Paycheck Calculator Smartasset Com Paycheck California Calculator

Salary To Hourly Salary Converter Salary Finance Math Equations

Gross Pay And Net Pay What S The Difference Paycheckcity

Payroll Calculator Free Employee Payroll Template For Excel

Post a Comment for "Ca Salary Paycheck Calculator"