13th Month Pay Labor Code Of The Philippines

Declaration of basic policy. COLA is not included in the computation.

Everything You Need To Know About 13th Month Pay Pressreader

851 employers from the private sector in the Philippines are required to pay their rank-and-file employees a Thirteenth 13th Month Pay not later than December 24 every year.

13th month pay labor code of the philippines. Thirteenth-Month Pay of Female Employee who is on Maternity Leave 40 J. 28 series of 2020 entitled Guidelines on the Payment of 13th Month Pay This is pursuant to Article 5 of the Labor Code of the Philippines Presidential Decree No. Under Presidential Decree No.

If a Filipino employee worked for less than a year regardless of the cause for the termination of his employment the amount due to him is determined by dividing the total salary he received by the number of months he was. Will I also receive my 13th month pay. 112 x 36512 083 x 3041 25 Computation.

28 Series of 2020 Labor Advisory No. 851 Updated legal resources on Philippine labour and industrial relations law social legislation termination of employment and labor standards laws statutes codes acts jurisprudence issuances philippine law philippines law philippine laws philippines laws. This Decree shall be known as the Labor Code of the Philippines.

The State shall afford protection to labor promote full employment. One-twelfth 112 of the thirteenth-month pay. Unless the parties provide for broader inclusions the term one-half 12 month salary shall mean fifteen 15 days plus one-twelfth 112 of the 13th month pay and the cash equivalent of not more than five 5 days of service incentive leaves.

What our laws require is the grant of service incentive leave of five days to those employees who have rendered at least one year of service. The following are the conditions for entitlement. SEPARATION PAY Following the labor code of the Philippines articles 283 and 284 state that an employee can claim separation pay if his contract is ended under authorized causes.

851 requiring employers in the private sector to pay their rank-and-file employees 13th Month Pay. Labor Code Of The Philippines 13th Month Pay. Coverage from Income Tax of the 13th Month Pay 41 14.

General Luna St Intramuros Manila 1002 Philippines. Philippines October 29 2020 On 19 October 2020 the Department of Labor and Employment DOLE issued Labor Advisory No. It is a mandatory benefit provided to.

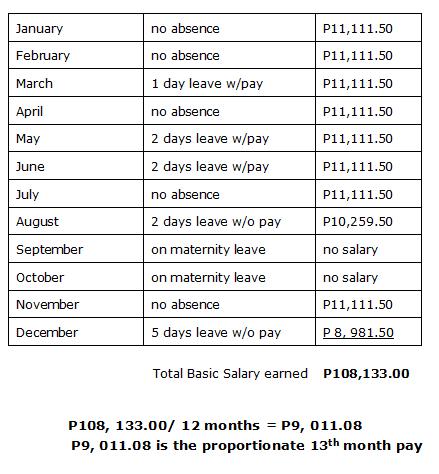

The 13th month pay of a resigned or separatedterminated employee is in proportion to the length of time he or she has worked during the year reckoned a from the time she has starting working during the calendar year or b the time the last 13th month pay was given up to the time of hisher resignation or separationtermination from the service. Employers in the Philippines are required to pay the 13th Month Pay to all relevant employees on or before 24 December each year. 28 which provides the Guidelines.

Employers can pay the 13th Month Pay benefit in installments but remember the full amount must be paid no later than 24 December. AOur laws do not require employers to grant their employees vacation leave and sick leave benefits. The Department of Labor and Employment DOLE issued Advisory No.

SEPARATION PAY Articles 298- 299 A. The 13th month pay in the Philippines is equivalent to 112 of the basic salary received by an employee within the year. One-Half Month Pay per Year of Service 42 B.

Minimum Retirement Pay Daily Rate x 225 days x number of years in service. 800 am - 500 pm except holidays. I will appreciate any advice you can extend.

The 13th month pay must be at least 112th of the total basic salary of each employee earned during that calendar year. THE 13TH MONTH PAY LAW PRESIDENTIAL DECREE NO. The 13th month pay is equivalent to one twelfth 112 of an employees basic annual salary.

According to article 282 an employee terminated for just cause neglect of duties fraud crime is. The 13th-month pay is a mandatory benefit provided to employees pursuant to Presidential Decree No. Department of Labor and Employment DOLE Building Muralla Wing cor.

13th Month Pay in the Philippines. The retirement pay shall be computed as follows. This Code shall take effect six 6 months after its promulgation.

Non-inclusion in Regular Wage 41 K. One-Month Pay per Year of Service 43. It is defined to mean one-twelfth 112 of the basic salary of an employee within a.

13th month pay is an additional compensation given to employees in the Philippines typically at the end of a year.

How To Compute Your 13th Month Pay Blog

How To Compute Your 13th Month Pay 2020 Jobs360

How To Compute For 13th Month Pay In The Philippines Coins Ph

How To Compute Your 13th Month Pay 2020 Jobs360

Https M5 Paperblog Com I 106 1064677 13th Month Pay L I Kwhx Jpeg

How To Compute Your 13th Month Pay 2020 Jobs360

Know More National Wages And Productivity Commission Facebook

Are Resigned National Wages And Productivity Commission Facebook

Hr Talk I Was Terminated During Ecq What Now And 11 Other Questions Answered About Getting Fired In The Phil Finding A New Job Question Answer Find A Job

13th Month Pay Mandatory Benefit In The Philippines

13th Month Pay In The Philippines Obligations For Employers Cloudcfo

How To Compute Your 13th Month Pay 2020 Jobs360

Hr Talk I Was Terminated During Ecq What Now And 11 Other Questions Answered About Getting Fired In The Phil Finding A New Job Question Answer Find A Job

A 13th Month Pay Guide For Employees

13th Month Pay Mandatory Benefit In The Philippines

A 13th Month Pay Guide For Employees

How To Compute Your 13th Month Pay 2020 Jobs360

Back Pay Computation And Guide For Working Filipinos

Post a Comment for "13th Month Pay Labor Code Of The Philippines"