What Does Total Annual Net Income Mean

32000 21000 53000 Total gross annual income If Sarah is eligible for deductions of 5000 for education andor childcare expenses she may be able to lower her taxable income in some jurisdictions. You also file a Schedule C to fully report your business income.

Gross Profit Margin Vs Net Profit Margin Formula

Instead he would have a net loss of 17500.

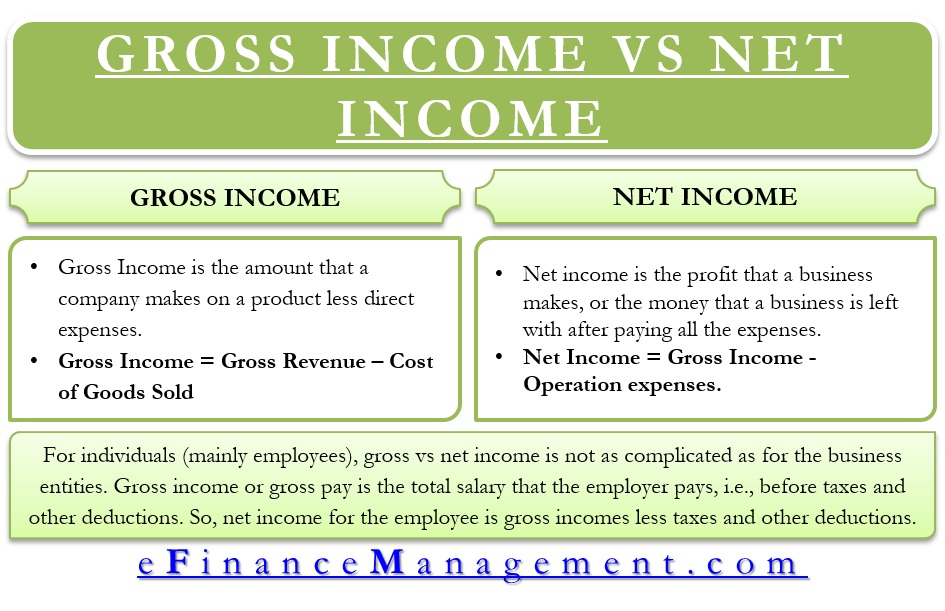

What does total annual net income mean. Gross means before taxes and net means after deducting taxes. Gross annual income is the sum of all income received from different sources during the calendar year that means from January 1 to December 31. What you receive in your bank account is net income.

All income that cannot be entered directly on Form 1040 W2 income goes on Schedule 1. Net income NI also called net earnings is calculated as sales minus cost of goods sold selling general and administrative expenses operating expenses depreciation interest taxes and. 53000 5000 48000 Net.

The definition of annual is yearly On a credit card application you report the amount of income you receive on a. Adjusted net income is total taxable income before any Personal Allowances and less certain tax reliefs for example. Its referred to sometimes as the companys bottom line because net income is at the bottom of the.

Therefore annual income means the amount of money obtained during a year. Trading losses donations made to charities through Gift Aid -. It is the sum of all income perceived by an individual in that 12-month period.

Enter your hourly pay and multiply it by the number of hours you work during the week. If youre applying for a new credit card purchasing a car applying for. Gross income is.

Annual net income is simply the net income for a given year four quarters in a row. For businesses net annual income or net profit equals the revenue a company generates in a year minus its costs such as purchases production expenses labor taxes interest expenses overhead utilities and other expenses. Total annual income is referred to as gross income on tax returns and is calculated before deductions and adjustments that result in the adjusted gross income Earned Income Sources Most people think of earned income as wages and salary income.

De très nombreux exemples de phrases traduites contenant total annual net income Dictionnaire français-anglais et moteur de recherche de traductions françaises. If you work by the hour you can figure out how with a calculator how much you earn in a year. If this is the case her net taxable income would be as follows.

Annual net income can be broken down as follows. What is her total annual income. Kyle can calculate his annual net income by subtracting total expenses 67500 from total income.

If you earn deposit interest or dividend income you must use the gross figures when calculating total income. If it has negative net income it is operating at a loss. Mar 13 2018 Annual income is the amount of money you make in one year.

Line 3 of Schedule 1 is where you enter your business income or loss. A Fiscal Year FY does not necessarily follow the calendar year. For example if you are self-employed.

Annual net income is the amount of money you make in a year after all deductions and taxes are subtracted out. This includes any 1099 income as an independent contractor or your net income as a sole proprietor. Its the amount of money that you actually have to spend on needs and wants and hopefully put into savings too.

Part I of Schedule 1 deals with Additional Income. Your total income is your gross income from all sources less certain deductions such as expenses allowances and reliefs. Total amount of money earned in a calendar year before taxes.

200000 minus 67500 132500. After all the deductions are taken from your gross annual income net annual income is left. You can determine your annual net income after subtracting certain expenses from your gross income.

Now what is net annual income and gross annual income. Depending on your earnings the amount of taxes paid in during the year and the total deductions you have it may be that you have money coming back from the Internal Revenue Service. Annual income is the total value of income earned during a fiscal year Fiscal Year FY A fiscal year FY is a 12 month or 52 week period of time used by governments and businesses for accounting purposes to formulate annual financial reports.

If a company has positive net income it has recorded a profit. What Does Annual Income Mean. Annual income can be expressed as a gross figure or a net figure.

Since annual means year if you are a salaried employee this is your salary for a year. The net income definition goes against the. However if Kyle only made 50000 of revenues for the year he would not have negative earnings.

To sum up - gross annual income is the amount of money your employer spent on you in a year. Since Kyles revenues exceed his expenses he will show 132500 profit. Then take that sum and multiply it by 52 which is the number of.

If you are married or in a civil partnership and jointly assessed your spouses or civil partners income is included in total income. What do the parts of annual net income mean. Annual net income is the amount of money you earn in a year after certain deductions have been removed from your gross income.

Your annual net income can also be found listed at the bottom of your paycheck. The annual net income is the yearly.

Net Earnings Definition Formula Investinganswers

How Do Net Income And Operating Cash Flow Differ

Net Income The Profit Of A Business After Deducting Expenses

Total Comprehensive Income Astra Agro Lestari Tbk 2017 2018 Financial Statements Accounting Income Financial Statement Income Tax

How Do Earnings And Revenue Differ

Net Profit Margin Accounting Play Learn Accounting Small Business Bookkeeping Accounting And Finance

How Do Operating Income And Revenue Differ

Difference Between Gross Income Vs Net Income Definitions Importance

Operating Income Vs Gross Profit

How To Find Net Income Calculations For Business

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

6 Essential Words To Understanding Your Business Finances Small Business Plan Small Business Finance Small Business Bookkeeping

How Do Net Income And Operating Cash Flow Differ

How To Calculate Net Income Formula And Examples Bench Accounting

:max_bytes(150000):strip_icc()/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)

Gross Profit Vs Net Income What S The Difference

What Is Gross Vs Net Income Definitions And How To Calculate Mbo Partners

Net Income The Profit Of A Business After Deducting Expenses

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "What Does Total Annual Net Income Mean"