Total Annual Income Of Us Citizens

1933 was the median wage per hour in the US in 2019. 65100 Average annual income of top 1 percent.

Average Annual Wages France 2019 Statista

In general the familys income may not exceed 50 of the median income for the county or metropolitan area in which the family chooses to live.

Total annual income of us citizens. 65 lignes When measured in current dollars the United States total personal income increased 48159 from 400B in 1959 to 19680B in 2020. Real Total Personal Income Indices 1958100. There are 34 million people below the poverty line in the US in 2019.

Retirement in New York is expected to last just over 16 years with an average retirement age of 64 years and an average life expectancy of 8080 years. There are also statistics for the average income of older adults. In 2020 341 of households or around 43791667 households made a six-figure income.

A better income depending where you live is 86505 which started the 75th percentile of earnings for 40 hour. The top 365 with incomes over 200000 earned 175. In 2020 median household income in the United States was 6840000.

This is the fifth consecutive annual. Current Population Survey CPS Annual Social and Economic ASEC Supplement. In 2008 all households in the United States earned roughly 124422 billion.

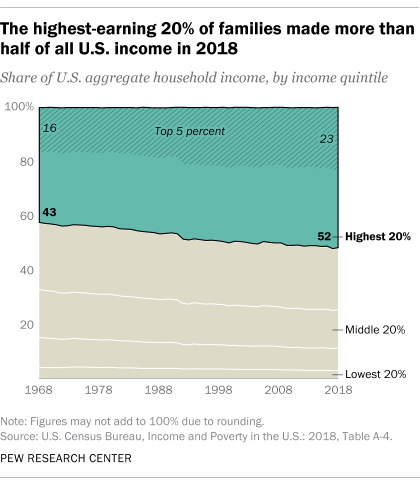

The top 1 wage earners in the US contribute 20 of American annual income. Published by Statista Research Department Jan 20 2021. How many US households made 100000 or more in 2020.

How many US households made 250000 or More in 2020. In 2018 the total personal income earned in the United States was 176 trillion. About 7825122 households or 609 of all US households made 250000 or more in 2020.

Eligibility for a housing voucher is determined by the PHA based on the total annual gross income and family size and is limited to US citizens and specified categories of non-citizens who have eligible immigration status. However because average yearly expenses are lower the average annual income to live comfortably is lower at 86171 per year. Average annual income of bottom 99 percent.

Households with annual. By law a PHA must provide 75. Income Taxes Paid millions 615716.

For these 16 years of. Median is a half-way point where half of a group has more income and half has less. The average wage in 2019 in the US was 5191627.

Average Income Taxes Paid. The tabs below are organized by Current Population Survey reference year. Median household income was 68703 in 2019 an increase of 68 percent from the 2018 median of 64324 Figure 1 and Table A-1.

Thats the median individual income for a person who typically worked 40 or more hours per week. A good income in the United States started around 52200 in 2020. This information is at a granular level but extremely helpful Since everyone pays into the Social Security system this is a good sense of how many people are earning income in the US According to this information 151 million Americans earned some sort of wages or compensation in 2011 The median wage in the US per person is 26695 This tells us a lot since the median household income is at.

Old-Age and Survivors Insurance. Spouses of retired workers. Personal income in the United States has risen steadily over the last decades from 49 trillion US.

These statistics are median income figures. The median household income in the US in 2019 was 68703. Children of retired workers.

The 2019 real median incomes of family households and nonfamily households increased 73 percent and 62 percent from their respective 2018 estimates Figure 1 and Table A-1. One half 4998 of all income in the US was earned by households with an income over 100000 the top twenty percent. Dollars in 1990 to 1968 trillion US.

In China urban households had an. When measured in constant 2012 dollars to adjust for inflation it advanced 6168 from 2470B in 1959 to 17705B in 2020. In 2019 a little more than 53 percent of Americans had an annual household income that was less than 75000 US.

Over one quarter 285 of all income was earned by the top 8 those households earning more than 150000 a year. Total monthly benefits millions of dollars Average monthly benefit dollars Number thousands Percent. Share of Total Income Taxes Paid.

The average income required to retire comfortably in New York is 83817 per year. Age of Householder-Households by Total Money Income Type of Household Race and Hispanic Origin of Householder.

6 Facts About Economic Inequality In The U S Pew Research Center

Payday Instant Cash Loans With Online Approval Process Instant Cash Loans Cash Loans Payday Loans

U S Personal Income 2020 Statista

How To File A Tax Extension A Complete Guide Infographic Tax Extension Filing Taxes Federal Taxes

Average Annual Wages France 2019 Statista

What Is The Average American Income In 2021 Policyadvice

U S Personal Income 2020 Statista

Sujit Talukder On Twitter Budgeting Income Tax Tax

Income Taxes And Small Businesses Income Tax Income Tax Brackets Tax Brackets

What Is The Average American Income In 2021 Policyadvice

2019 Marriage Visa Income Requirements For The Sponsoring Spouse Boundless Immigration Income Statement Profit And Loss Statement Statement Template

Salary Budget Increases Projected For 2021 On Par With Those Recorded For 2020 Finds Xperthr Survey

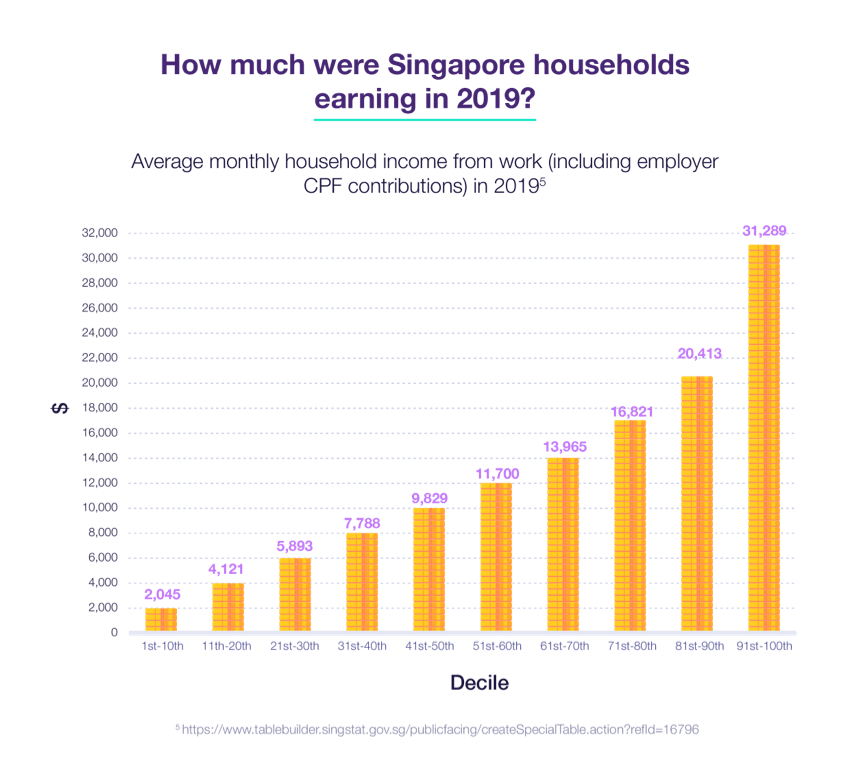

Are You Earning Enough Singapore S Average Household Income Revealed Standard Chartered Singapore

What Is The Average American Income In 2021 Policyadvice

Revealed The Top Demographic Trends For Every Major Social Network Social Media Demographics Social Media Infographic Social Media Statistics

Canada Total Income Distribution By Income Level 2018 Statista

Your Day In A Chart 10 Cool Facts About How Americans Spend Our Time Leisure Emotional Health Mental And Emotional Health

Post a Comment for "Total Annual Income Of Us Citizens"