Mortgage Loan Originator Compensation Rule

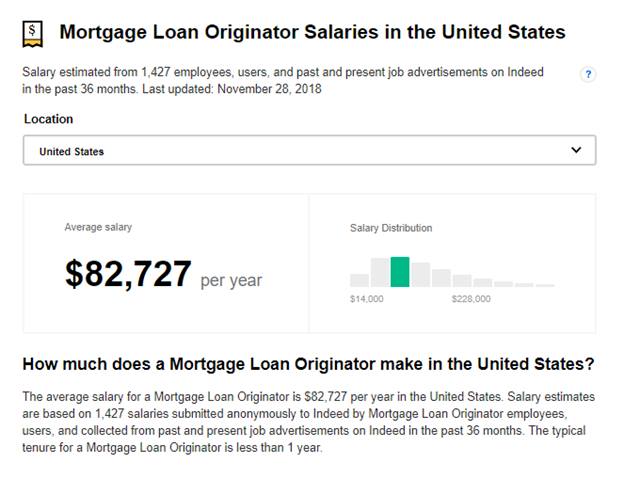

If the loan originators compensation is reportable on a W-2 use the amount reportable for Medicare tax purposes in box 5. Instead the Bureau will first study how points and fees function in the market and the impact of this and other mortgage-related rulemakings.

How Much A 100 000 Mortgage Will Cost You Credible

1 On January 10 2014 the CFPB enacted the Rule which brought small mortgage lenders and seller or private financers under a previously unknown level of.

Mortgage loan originator compensation rule. Loan originators may not receive compensation based on the terms of a transaction except for payments based on fixed percentage of the loan amount. 102636 d Prohibition on payment based on terms of the transaction. The rule was enacted after the financial crisis to eliminate the practice of LOs steering borrowers into costlier loans in order to earn.

One of the CFPBs first endeavors was to enact the Loan Originator Compensation Rule the Rule which implements Dodd-Franks requirements as set by Congress. To prevent evasion the final rule generally prohibits loan originator compensation from being reduced to offset the cost of a change in transaction terms often called a pricing concession. However the final rule allows loan origin ators to reduce their compensation to defray certain unexpected increases in estimated settlement costs.

The rule also prohibits the loan officer or broker from being paid by both the consumer and another person such as the creditor ie. To the existing loan originator compensation rule that should alleviate. November 2019 40 Updated to reflect the 2019 Loan Originator Interpretive Rule which clarifies that loan originator organizations are not required to comply with certain screening and training requirements in the Loan Originator Rule for individual loan originators while they are authorized to act as a loan originator with temporary authority.

The LO Comp Rule prohibits compensation of loan originators based on the terms of a mortgage loan or multiple mortgage loans such as interest rate. The rule generally regulates how compensation is paid to a loan originator in most closed-end mortgage transactions as described throughout this letter. The Rule functions as a series of amendments to Regulation Z.

The Rule attempts to restrict loan officer compensation and so-called steering tactics where the loan originator tries to place a borrower into a more expensive product that generates more commission. Additionally the rule contains provisions prohibiting mandatory arbitration waiving certain federal claims and financing credit insurance premiums in closed-end mortgage transactions and open-end credit including home equity lines of. Scope of the Rule This rule applies to all mortgage loan originators MLOs and the organizations that employ them.

The Loan Originator Compensation Rule The CFPB issued its final loan originator compensation rule Rule back on January 20 2013. Rule Issued on LO Comp Rules address steering. Youll learn who is covered what is allowed what you must do to make your program fit within the rule and what you need to continually monitor.

For closed-end reverse mortgages a loan originators compensation may be based on either a the maximum proceeds available to the consumer under the loan. At this time the Bureau is not prohibiting payments to and receipt of payments by loan originators when a consumer pays upfront points or fees in the mortgage transaction. Because profits resulting from mortgage loans are directly tied to the terms of the loan compensation based on profitability is prohibited except in limited circumstances.

Final rule Loan Originator Compensation Rule. The rule generally prohibits compensation to mortgage loan originators based on a term of an individual transaction the terms of multiple transactions by an individual loan originator or the terms of multiple transactions by multiple loan originators. Or b the maximum claim amount if the mortgage is subject to 24 CFR.

The final rule revises or provides additional commentary on Regulation Zs restrictions on loan originator compensation including application of these restrictions to prohibitions on dual compensation and compensation based on a term of a transaction or a proxy for a term of a transaction and to. The final rule also establishes tests for when loan originators can be compensated through certain profits-based compensation arrangements. Loan Originator Compensation Requirements under the Truth.

Part 206 or the appraised value of the property as determined by the appraisal used in underwriting the loan if the mortgage is not subject to 24 CFR. Main loan originator rule provisions and official interpretations can be found in. Compensation may still be based on loan volume and with certain limitations on loan amount.

The new rules are required under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. The LO Comp rule dictates how loan originators are paid. If the loan originator is an independent contractor use the amount of compensation reportable on IRS form 1099-MISC.

Final servicing rules and the loan originator compensation rule. 102636 d Prohibition on dual compensation. Loan originators may not receive compensation from both the consumer and another party such as a creditor referred to as dual compensation.

102636 a Definitions including compensation and loan originator. Inside Mortgage Finances Guide to the CFPBs Loan Originator Compensation Rule updated in April 2016 closely examines the bureaus regulation contrasts its differences with previous regulation and discusses important compliance and enforcement concerns. Rules governing compensation practices of mortgage loan originators were first issued by the Federal Reserve Board in 2010.

For a loan originator who receives both W-2 and 1099-MISC income add both amounts together. The Dodd-Frank Act added certain provisions to the 2010 rule and the Bureau has issued.

Getting A Mortgage The Four C S Of Credit Mortgage Loans Mortgage Lenders Top Mortgage Lenders

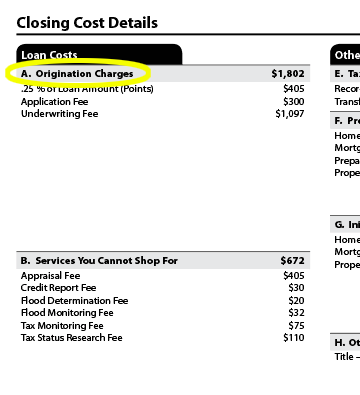

The Loan Estimate And Closing Disclosure What They Mean Nerdwallet

Pin By Lottieaeriellchristynayb On Mortgage Mortgage Tips How To Get Money Mortgage Marketing

4 Ways To Pay Off Your Mortgage Faster Infographic Paying Off Mortgage Faster Mortgage Payoff Mortgage Fees

Smart Tips To Improve Your Home Loan Eligibility And Make Loan Process Hassle Free Home Loans Loan Improve Yourself

Mortgage Loan Processing Demonstration Youtube

Pdf Discrimination In Mortgage Lending Evidence From A Correspondence Experiment

Loan Agreement Contract Mortgage Loan Document Template Text Png Pngegg

How Much Home Loan Can You Take Home Refinance Home Loans Loan

Https Www Icba Org Docs Default Source Icba Advocacy Documents Summaries Icbasummaryloanoriginator Pdf Sfvrsn 654d9808 4

What Is A Mortgage Loan Mortgage Loans Mortgage Home Mortgage

Loan Officer Commission Split The Ultimate Guide

Top 5 Benefits Of Becoming A Mlo Mlo Training Academy

Shashank Saini Mortgage Mortgage Tips Home Mortgage

Property Loan In France The Guide French Touch Properties

Tracker Loan Compensation Loan Analysis Solutions Refinancing Mortgage Loan Mortgage Interest Rates

Mortgage Loan Officer Assistant Disc Profile Wizehire

Post a Comment for "Mortgage Loan Originator Compensation Rule"