Monthly Salary Tax Calculator Uk

The UK PAYE tax calculator salary calculator is active since 1998. We are happy to be considered as the number one calculator on the internet for calculating earnings proving an invaluable tool alongside any small business accounting solution or corporate payroll software.

Salary And Tax Deductions Calculator The Accountancy Partnership

If you are looking for a feature which isnt available contact us and we.

Monthly salary tax calculator uk. The 202021 tax calculator provides a full payroll salary and tax calculations for the 202021 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations and more. Salary Before Tax your total earnings before any taxes have been deducted. Find out your take-home pay - MSE.

UK Tax Salary Calculator Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. Annonce Stay Connected to the Most Critical Events of the Day with Bloomberg. Our online income tax calculator will help you work out your take home net pay based on your salary and tax code.

The Monthly Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National Insurance Dividends Company Pension Deductions and more. Estimate your Income Tax for the current year. ICalculator Monthly salary sacrifice calculator is updated for the 202122 tax year.

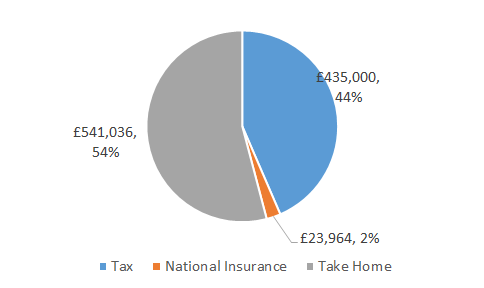

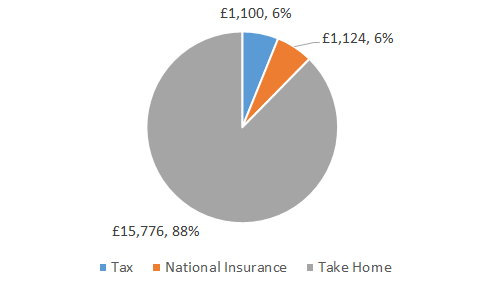

Youll then get a breakdown of your total tax liability and take-home pay. This means that after tax you will take home 2570 every month or 593 per week 11860 per day and your. The most recent rates and bands from HMRC inland revenue and UK.

We strongly recommend you agree to a gross salary. Completed overhauled for 2019-19 tax year our new salary and tax calculator is built to support all your salary and payroll audit needs. Calculate your take-home pay given income tax rates national insurance tax-free personal allowances pensions contributions and more.

UK Monthly Income Tax Calculator This is the most advanced income tax calculator providing a visual breakdown of how your salary is broken up for tax and other deduction purposes. Your gross hourly rate will be 2163 if youre working 40 hours per week. Our salary calculator builds upon our comprehensive calculation system to provide you with an accurate breakdown of your salary by factoring income taxes national insurance and other deductions such as student loans and pensions.

Find out how much money you will actually receive based on your weekly monthly or annual wages. We offer you the chance to provide a gross or net salary for your calculations. The calculator is updated for the UK 2021 tax year which covers the 1 st April 2021 to the 31 st March 2022.

Use the simple monthly salary sacrifice calculator or switch to the advanced monthly salary sacrifice calculator to review employers national insurance payments income tax deductions. Annonce Stay Connected to the Most Critical Events of the Day with Bloomberg. You can calculate your Monthly take home pay based of your Monthly gross income salary sacrifice adjustment PAYE NI and tax for 202122.

These figures are adjusted annually and may vary across different regions of the UK. Simply enter your annual or monthly income into the salary calculator above to find out how UK taxes affect your income. This simple tool calculates tax paid and national insurance contributions.

Our salary calculator will provide you with an illustration of the costs associated with each employee. Work out your take home pay with our online salary calculator. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself.

In 20202021 this is set at 12500. Please see the table below for a. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage.

The results are broken down into yearly monthly weekly daily and hourly wages. Most people can earn a certain amount tax free. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022.

After tax - UK Salary Tax Calculator 40000 After Tax If your salary is 40000 then after tax and national insurance you will be left with 30840. Youll pay 6500 in tax 4260 in National Insurance and your yearly take-home will be 34240. If your salary is 45000 a year youll take home 2853 every month.

Use the online salary tool to see how a change of income will affect how. Tax is then calculated according to the amount you earn with a 20 tax rate for income up to 37500 and 40 tax on amounts above this to 150000. You will see the costs to you as an employer including tax NI and pension contributions.

Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below.

First Salary In The Uk Not Being Taxed Personal Finance Money Stack Exchange

Ask Sage Income Tax Paye General Information And Manual Calculations

Tax On Bonus How Much Do You Take Home Uk Tax Calculators

Income Tax Co Uk Uk Tax Calculator Home Facebook

How To Calculate Income Tax In Excel

Uk Salary Tax Calculator 2021 2022 Calculate My Take Home Pay

Calculate Uk Income Tax Using Vlookup In Excel Progressive Tax Rate Youtube

35 000 After Tax 2021 Income Tax Uk

How To Calculate Foreigner S Income Tax In China China Admissions

How To Create An Income Tax Calculator In Excel Youtube

Income Tax Co Uk Uk Tax Calculator Home Facebook

Income Tax Co Uk Uk Tax Calculator Home Facebook

Comparison Of Uk And Usa Take Home The Salary Calculator

Income Tax Co Uk Uk Tax Calculator Home Facebook

How To Calculate Income Tax In Excel

Comparison Of Uk And Usa Take Home The Salary Calculator

Ask Sage Income Tax Paye General Information And Manual Calculations

Post a Comment for "Monthly Salary Tax Calculator Uk"