Monthly Salary Calculator Hmrc

From 6 April 2021 the employees salary is paid by 12 equal monthly instalments. Calculate your monthly net pay based on your yearly gross income with our salary calculator.

How To Calculate Salary After Tax Uk Tax Walls

So in this calculator which uses monthly.

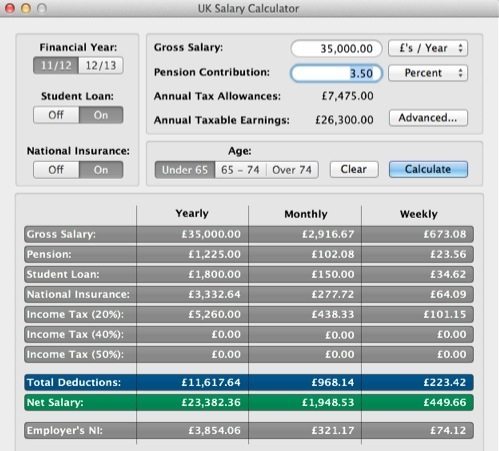

Monthly salary calculator hmrc. You can enter your basic pay overtime commission payments and bonuses. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Accommodation National Minimum Wage and National Living Wage rates. If you know your tax code you can enter it or else leave it blank. Select how often you are paid - Monthly 4-Weekly 2-Weekly Daily.

Use SalaryBots salary calculator to work out tax deductions and allowances on your wage. Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. How to use the Take-Home Calculator.

If your employee works Monday to Friday and started work on the 11 th of January 2016 you would pay them for 15 days. ICalculator Monthly salary sacrifice calculator is updated for the 202122 tax year. The latest budget information from April 2021 is used to show you exactly what you need to know.

5 hours double time would be 5 2. Hourly rates weekly pay and bonuses are also catered for. Accurate fast and user friendly UK salary calculator using official HMRC data.

It is important to understand that National Insurance is calculated on the period you are paid. Our salary calculator builds upon our comprehensive calculation system to provide you with an accurate breakdown of your salary by factoring income taxes national insurance and other deductions such as student loans and pensions. Completed overhauled for 2019-19 tax year our new salary and tax calculator is built to support all your salary and payroll audit needs.

For overtime you must enter your hourly rate then either enter the amount in. If the pay period we come up with doesnt match try a nearby date which matches. The results are broken down into yearly monthly weekly daily and hourly wages.

Our tax calculator uses tax information from the tax year 2014 2015 to show you take-home pay if you need to see details of PAYE and NI for a different year please use our advanced options. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10 15. Start date for claim period End date for claim period.

This calculator allows you to enter you monthly income for each month throughout the tax year. Enter the number of hours and the rate at which. The calculator then provides monthly PAYE and NI deductions and an annual figure overview of deductions so you can review monthly amounts and annual averages for standard payroll deductions.

Enter your pay details. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. This calculator can be used to estimate the amount that can be claimed for each separate month.

If an employees monthly pay spans more than one calendar month eg. Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below. National Minimum Wage and Living Wage calculator for workers National Minimum Wage and Living Wage.

Find out the benefit of that overtime. Select or Enter the payslip date - we will automatically calculate the pay period. 23rd March to 22nd April the employer should submit two separate claims.

Salary divided by 12 months in the year and then divided by the number of working days in the month you will pay them for the number of days they have worked eg. To calculate 80 of the wages from the corresponding calendar period in a previous year. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

This tells you your take-home pay if. To use the tax calculator enter your annual salary or the one you would like in the salary box above. Calculate your leave and pay when you have a child.

Then take P to be 1 and calculate D in months rather than days see example 3 at EIM13888. The simple NIPAYE calculator allows you to calculate PAYENI on the salary that you pay yourself out of your limited company. The 202021 tax calculator provides a full payroll salary and tax calculations for the 202021 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations and more.

You can calculate your Monthly take home pay based of your Monthly gross income salary sacrifice adjustment PAYE NI and tax for 202122. Why not find your dream salary too. Find out if you can get maternity paternity or shared parental leave for employees.

Start with the amount they earned in the corresponding part of the lookback period.

90 000 After Tax Take Home Pay Calculator 2021

Income Tax Co Uk Uk Tax Calculator Posts Facebook

Salary And Tax Deductions Calculator The Accountancy Partnership

Top 77 Similar Websites Like Netsalarycalculator Co Uk And Alternatives

Uk Salary Calculator 2021 22 By James Still Ios United Kingdom Searchman App Data Information

Six Apps To File Taxes On The Mac Chriswrites Com

Comparison Of Uk And Usa Take Home The Salary Calculator

Top 77 Similar Websites Like Netsalarycalculator Co Uk And Alternatives

![]()

Salary And Tax Deductions Calculator The Accountancy Partnership

Finance Entry Level Jobs Wage Calculator After Tax

Ethiopian Salary Calculator Apk For Android Mnet Technology

![]()

Multiple Income Tax Calculator Uk Tax Calculators

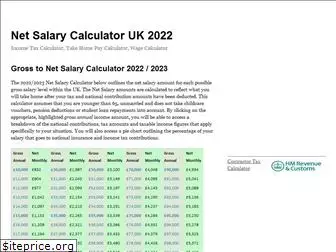

Net Salary Calculator Uk 2021 Income Tax Calculator Take Home Pay Calculator Wage Calculator

45 000 After Tax 2021 Income Tax Uk

Finance Entry Level Jobs Wage Calculator After Tax

Income Tax Co Uk Uk Tax Calculator Posts Facebook

Salary And Tax Deductions Calculator The Accountancy Partnership

How To Calculate Salary After Tax Uk Tax Walls

Top 77 Similar Websites Like Netsalarycalculator Co Uk And Alternatives

Post a Comment for "Monthly Salary Calculator Hmrc"