Monthly Salary Calculator Canada

If you make 52000 a year living in the region of British Columbia Canada you will be taxed 10804. You assume the risks associated with using this calculator.

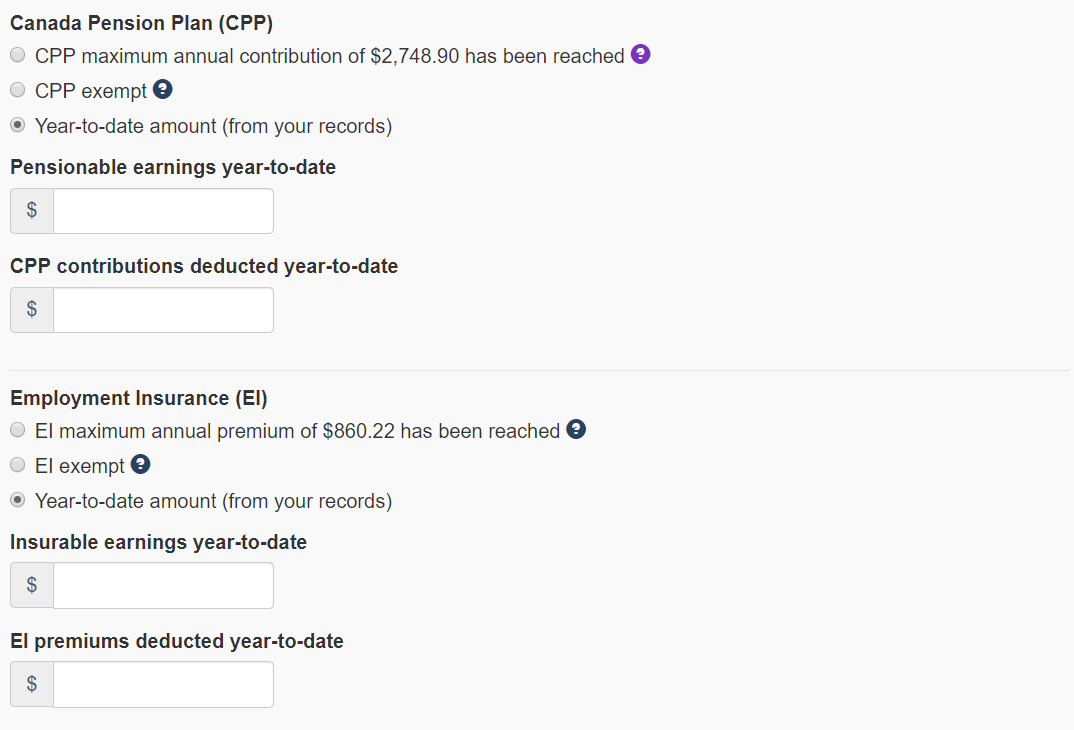

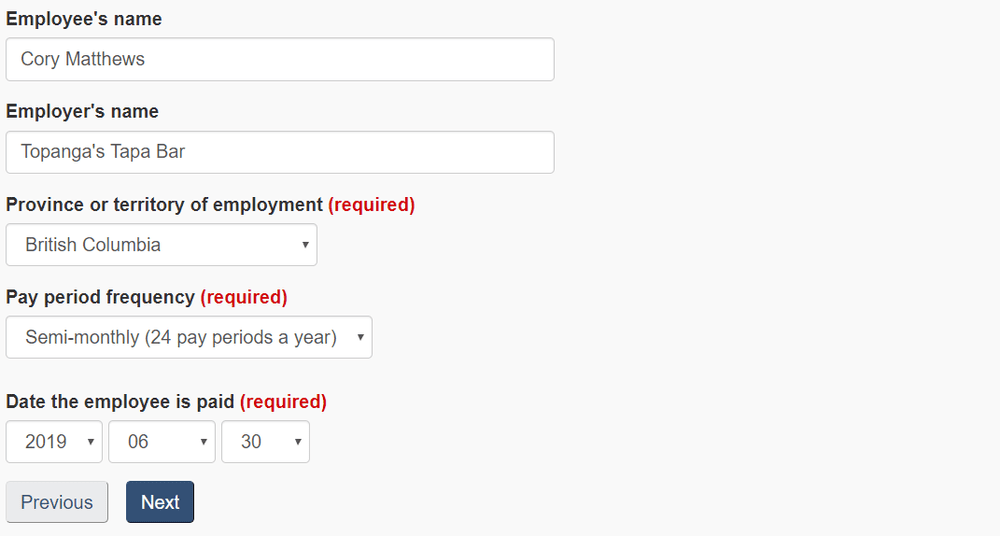

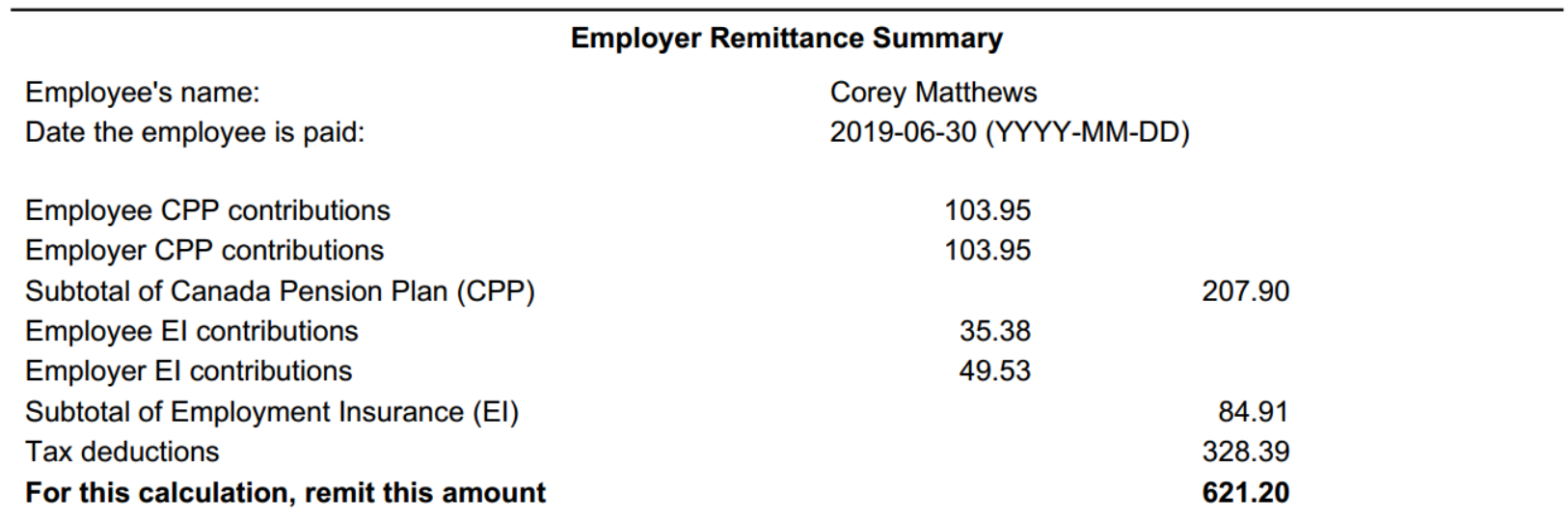

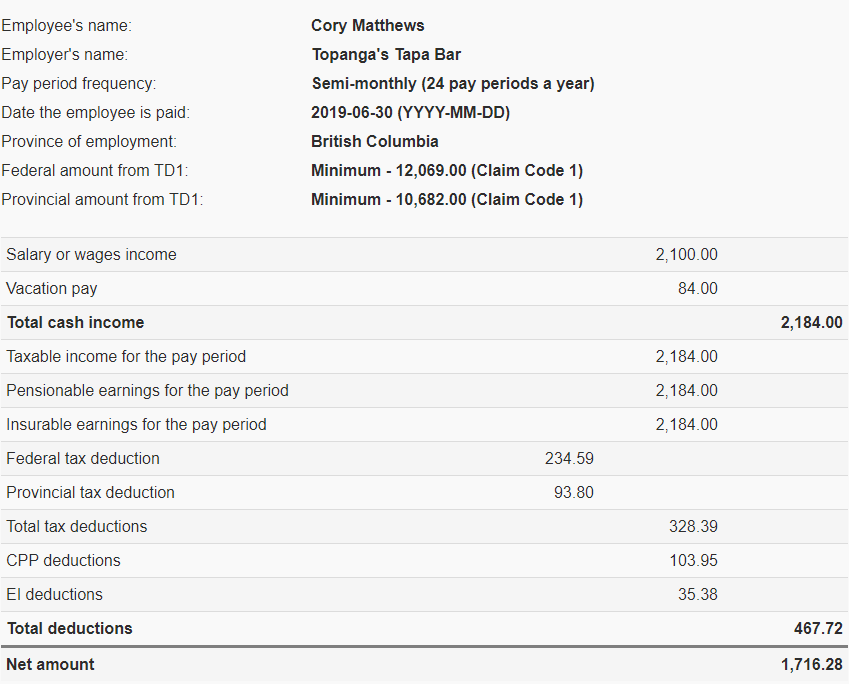

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

The reliability of the calculations produced depends on the accuracy of the information you provide.

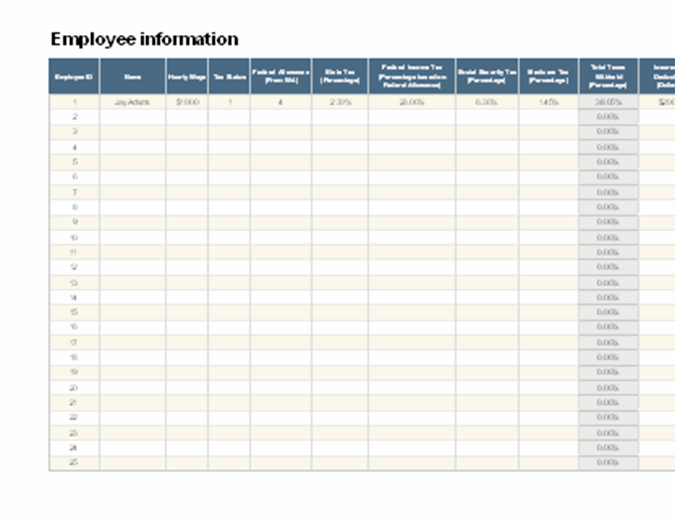

Monthly salary calculator canada. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary Net annual salary Weeks of work year Net weekly income. It is perfect for small business especially those new to doing payroll. Salary Calculator - Automatically Convert Hourly to Annual.

Hourly Pay Rate. Now you can go back to the Dues or Strike Calculator you were working on and enter the. As of January 2020 the average Canadian salary in 2020 was 105059 per week for employees across the country which means that the annual average salary for full-time employees is just over 54630 per year.

The payroll calculator from ADP is easy-to-use and FREE. Enter your pay rate. Use this simple powerful tool whether your staff is paid salary or hourly and for every province or territory in Canada.

That means that your net pay will be 41196 per year or 3433 per month. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. The category of fishing and hunting guides is not considered in this calculator as it is very specific.

The Wage and Salary Conversion Calculator is used to convert a wage stated in one periodic term hourly weekly monthly etc into its equivalent stated in all other common periodic terms. Use the simple monthly Canada tax calculator or switch to the advanced Canada monthly tax calculator to review. That means that your net pay will be 40512 per year or 3376 per month.

Select a pay period hourly weekly monthly etc and enter a wage value for that pay period. Canadian Payroll Calculator by PaymentEvolution. This is required information only if you selected the hourly salary option.

If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month to calculate monthly salary. Results include unadjusted figures and adjusted figures that account for vacation days and holidays per year. Enter the number of hours worked a week.

ADP Canada Canadian Payroll Calculator. It will confirm the deductions you include on your official statement of earnings. PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada.

The Canada Monthly Tax Calculator is updated for the 202122 tax year. 37 x 50 1850 hoursNext take the total hours worked in a year and multiply that by the average pay per hour. The amount can be hourly daily weekly monthly or even annual earnings.

Youll then get a breakdown of your total tax liability and take-home pay. Your average tax rate is 208 and your marginal tax rate is 338. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Then click the Convert Wage button to see the wage converted to. Select the province. Examples of payment frequencies include biweekly semi-monthly or monthly payments.

Annual salary without commas average weekly hours Take one of the two calculated amounts from the boxes on the right. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in France affect your income. Before taxes or any other deductions Gross Monthly Pay.

This is equal to 37 hours times 50 weeks per year there are 52 weeks in a year but she takes 2 weeks off. The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Formula for calculating net salary The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance.

To start complete the easy-to-follow form below. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488. Annual Salary Paid Employees Only whether paid bi-weekly semi-monthly or other Enter annual salary.

Oct 28 2018 First calculate the number of hours per year Sara works. Salary Before Tax your total earnings before any taxes have been deducted. If you are paid an even sum for each month to convert annual salary into monthly salary divide the annual salary by 12.

Enter the number of pay periods. Your average tax rate is 221 and your marginal tax rate is 349. The salary trend is positive and the majority of Canadian workers are earning more than they did in the previous year.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Also known as Gross Income. For 2021 until september 30 2021 the province of Ontario as decided to make an increase in the minimum wage of 025 over 2020 from 14 to 1425 per hour.

The calculator is updated with the tax rates of all Canadian provinces and territories. You can calculate your Monthly take home pay based of your Monthly gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax Tables.

Mathematics For Work And Everyday Life

Temporary Wage Subsidy For Employers How To Calc

Annual Income Learn How To Calculate Total Annual Income

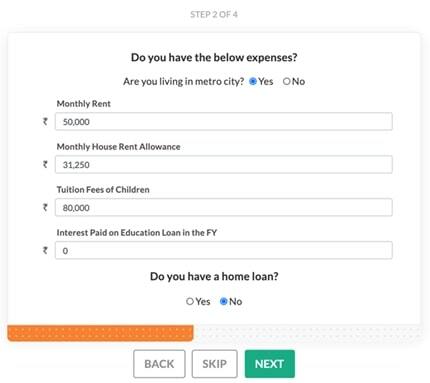

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

The Salary Calculator Tells Your Yearly Net Income In Vancouver After Income Tax And National Insurance Contributions Have Salary Calculator Salary Net Income

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Calculating How Much Money I Need To Retire Homeequity Bank

Canada Global Payroll And Tax Information Guide Payslip

How To Calculate Payroll Tax Deductions Monster Ca

In Hand Salary Calculator 2021 Pay Slips Monthly Tax India

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

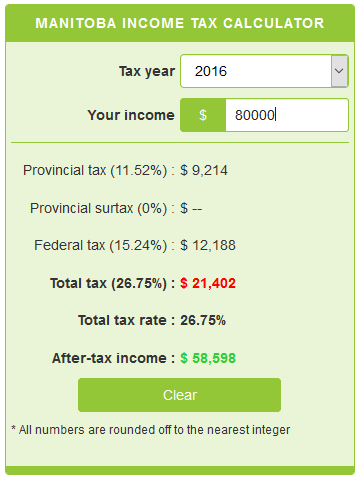

Manitoba Income Tax Calculator Calculatorscanada Ca

How To Calculate Foreigner S Income Tax In China China Admissions

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Post a Comment for "Monthly Salary Calculator Canada"