Ca Salary Rules

In general an employee has to make at least 455 per week 23660 per year be paid on a salary basis and perform exempt duties that require discretion and independent judgment at least 50 of. All California employees including those who earn commissions have the right to be paid for their work.

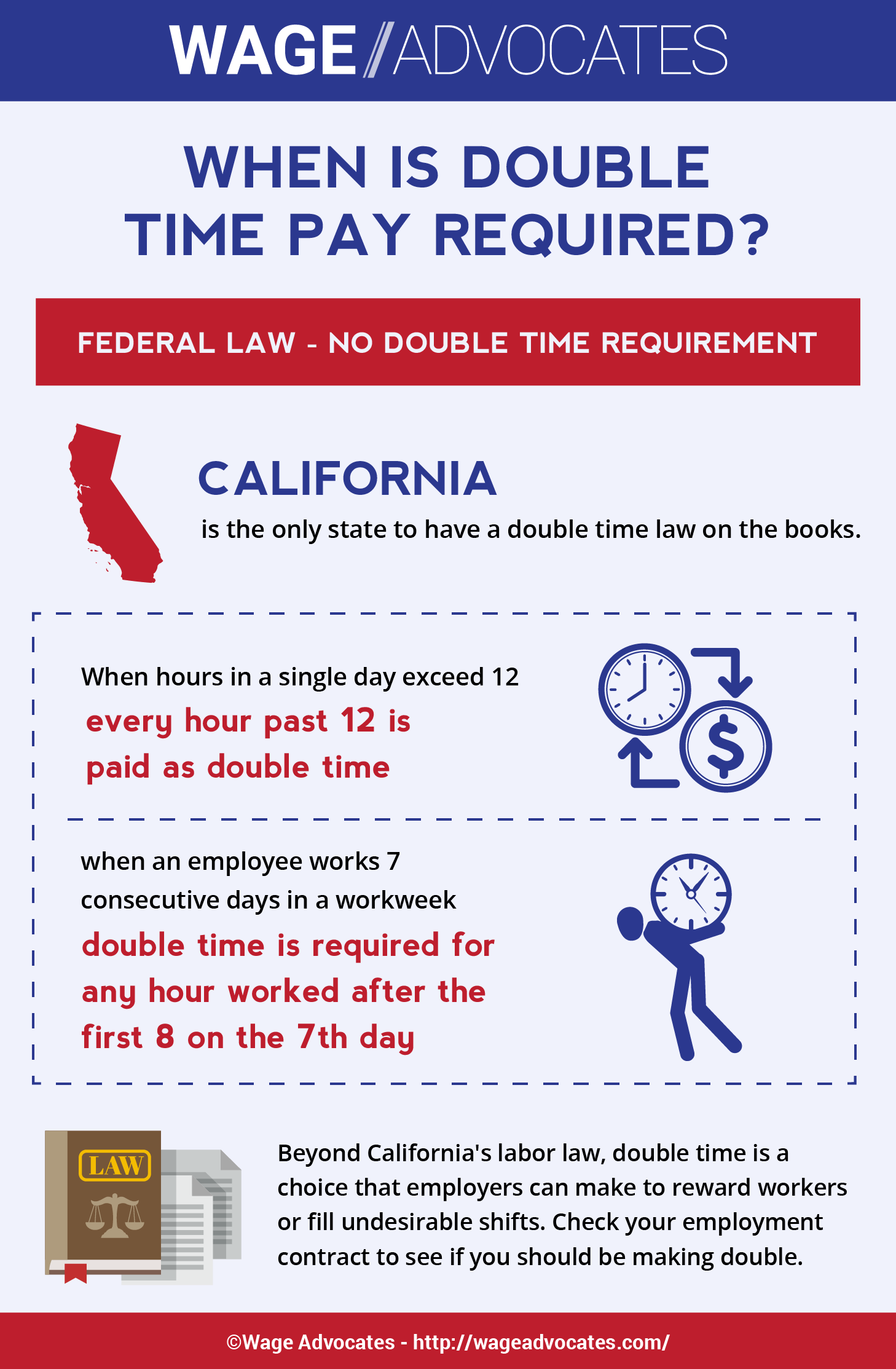

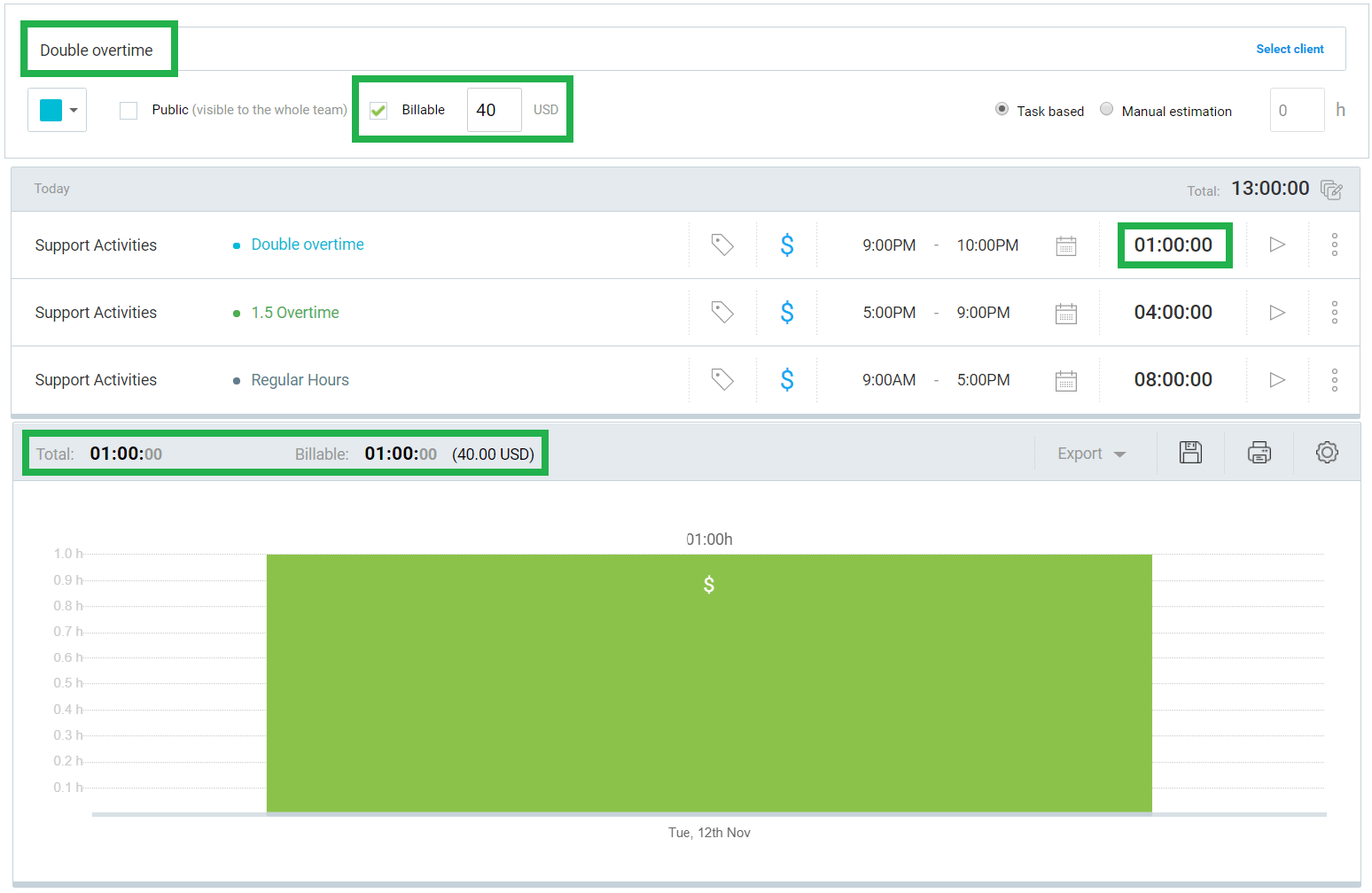

What Is Double Time Pay When Is It Mandatory Overtime Lawsuit

Introduction to the CALHR Rules Pg Slide Content 4.

Ca salary rules. The average salary of Chartered Accountants in India ranges from 6-7 lakhs to 30 lakhs. Often benefits like 401k come with the position. DLSE adjudicates wage claims on behalf of workers who file claims for nonpayment of wages overtime or vacation pay pursuant to California Labor Code sections 96 and 98.

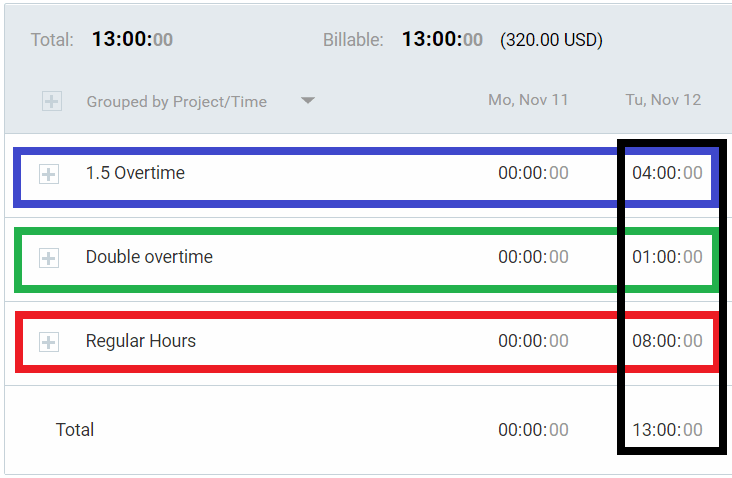

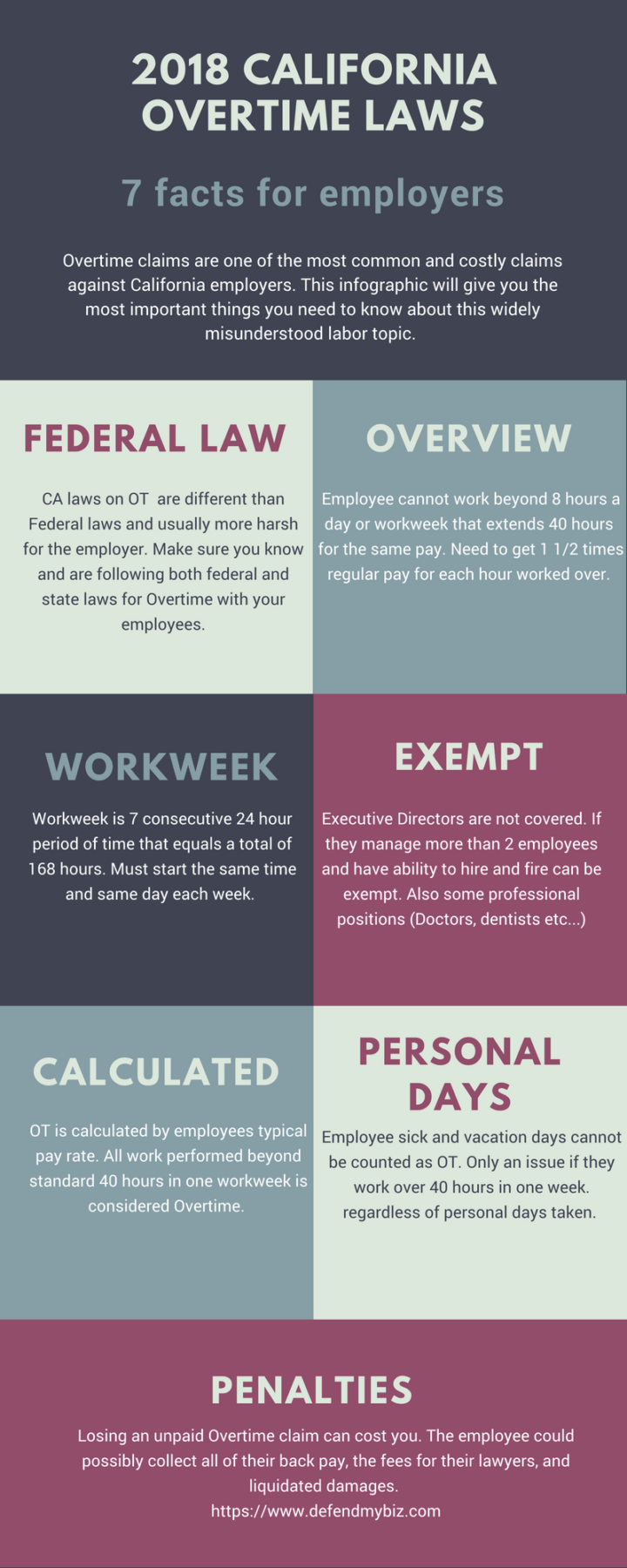

According to Salary Rule Sections 599673 599674 or 599676 Over 120 higher class salary According to salary rules prior to filing grievance DPA Rule 599859 STS_ListItem_DocumentLibrary httpswwwcalhrcagov_layouts15WopiFrameaspxsourcedoc7Babbd1261-15c0-47fd-a948-df1bc7f176ea7Dactioninteractivepreview. Some employees are paid a commission basis. Nonexempt salaried workers who work more than 40 hours a week also get overtime an employer cannot require them to work more than that without overtime pay.

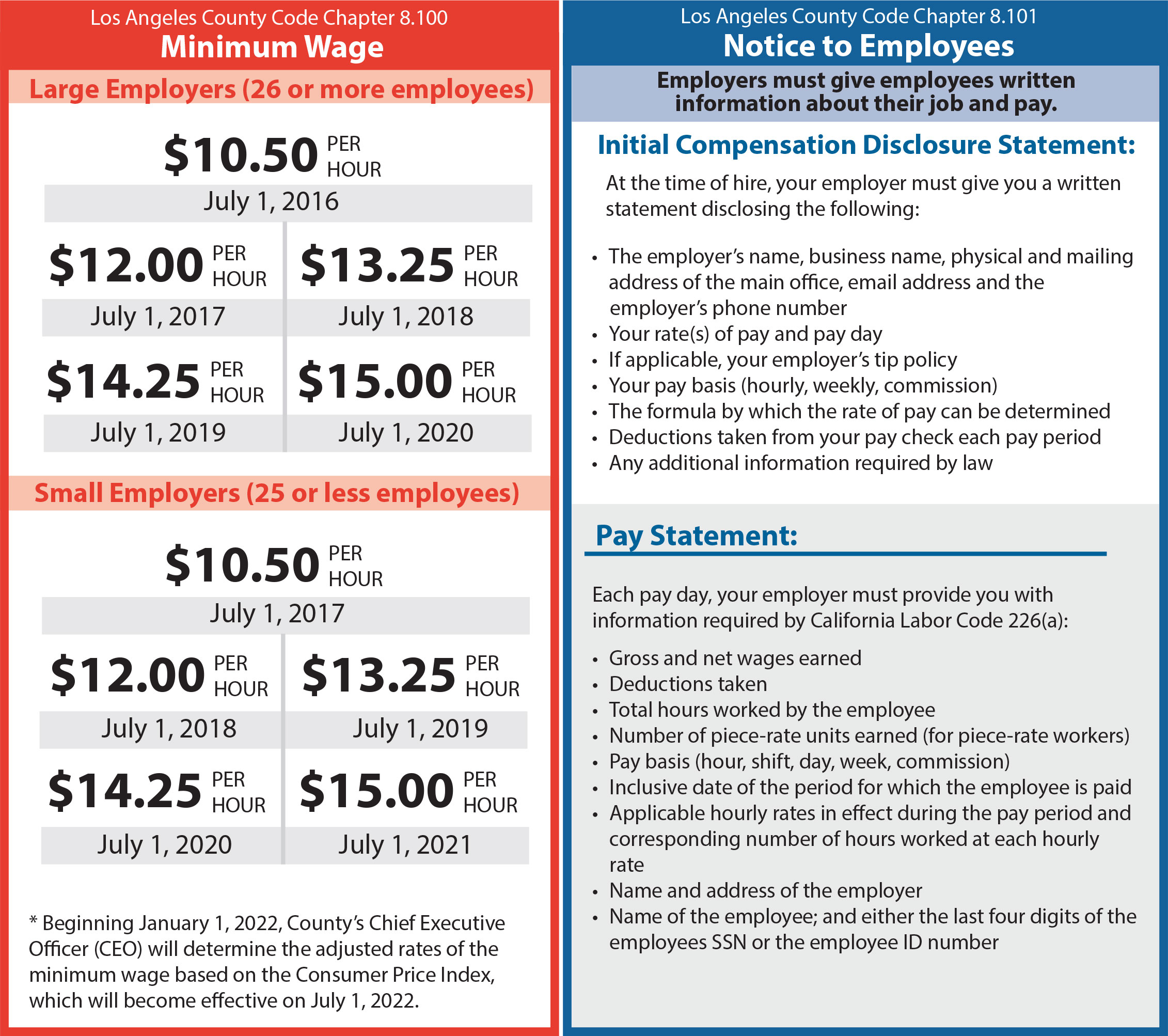

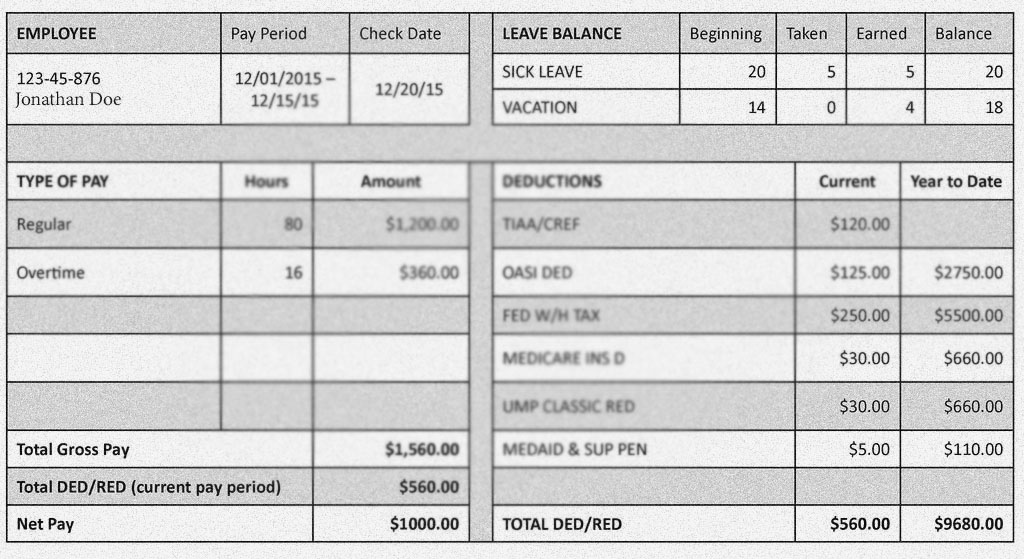

The employer must establish a regular payday and is required to post a notice that shows the day time and location of payment. Likewise nonexempt workers may receive a predetermined salary but it should be equal to the federal minimum wage or the state minimum wage whichever one is higher. They also have the right to be paid on time.

Last years stats show that the average salary of CAs in India was offered around 736 lakhs pa. And in some cases they have the right to be paid overtime. SalaryOfCA SalaryIn this video i have discussed salary of CA in details and you would be amazed that it is applicable all over Asian countriesWell aperso.

541600a To qualify as an exempt executive administrative or professional employee under section 13a1 of the Act an employee must be compensated on a salary basis at a rate of not less than 455 per week or 380 per week if employed in American Samoa by employers other than the Federal Government exclusive of board lodging or other facilities. The salary of a Chartered Accountant in India depends on hisher skills capabilities and experience. A person receiving a salary should not get less pay than an employee working the same hours for minimum wage.

If you are paid a salary the regular rate is determined as follows. The minimum salary requirement for 2021 for white-collar workers is 54080 for employers with 25 or fewer employees and 58240 for employers with 26 or more employees. 4 to 6 lakh per annum after completing the final course.

Salary options are not bright during articleship but candidates can expect a good salary after completing the course. In California those who work 40 hours a week should earn a weekly salary of at least 520 or 27040 annually. Paydays pay periods and the final wages.

A salaried employee may work more than 40 hours or less than 40 hours and the salary remains the same unless the employer makes special conditions. International packages are even higher ranging up to 75 lakhs. The average starting salary of a CA varies from Rs.

Salaried positions offer more job security in most industries and often have opportunities for advancement into higher paying management positions. The Chartered Accountant according to survey in 2019 is paid the average hourly salary of Rs 700 ranging from minimum of Rs 500 to 3000 monthly average salary Rs 55000 ranging from a minimum of Rs 10000 to 150000. The salary of a CA depends on the city and company he.

If an exempt employees salary drops below the minimum salary requirement the employee may no longer be considered exempt. DLSE deputies hold informal conferences between employers and employees to resolve wage disputes. Divide the annual salary by 52 weeks to get the weekly salary.

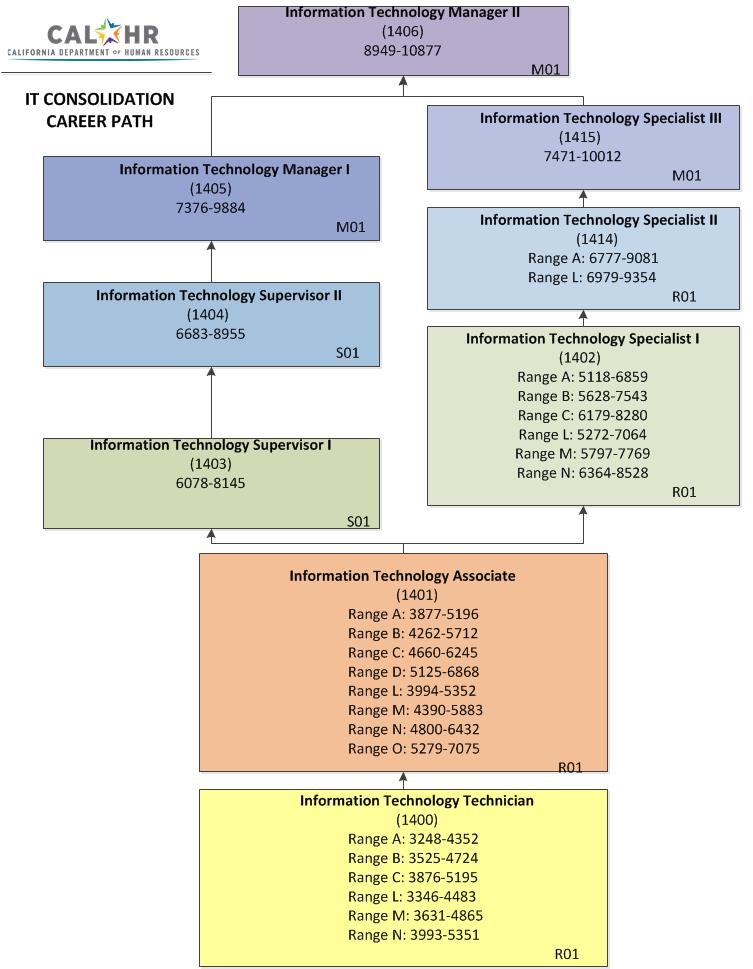

Ppsdtrainingscocagov to request assistance. Objectives Identify the seven different CCR salary rules Determine which rule applies to various situations. Divide the weekly salary by the number of legal maximum regular.

Multiply the monthly remuneration by 12 months to get the annual salary. CAs are in great demand within auditing firms banks finance companies stockbroking firms legal firms etc. Effective from January 1 2020 California labor law requires employers with at least 26 employees to pay 1040 every week or 54 080 per annum.

In California wages with some exceptions see table below must be paid at least twice during each calendar month on the days designated in advance as regular paydays. The purpose of this eLearning is to introduce the California Department of Human Resources CalHR salary rules that you will practice following the. Many translated example sentences containing salary rules French-English dictionary and search engine for French translations.

Hourly wages and fixed salaries are the most common examples. 2 Advanced Salary Determination. De très nombreux exemples de phrases traduites contenant salary rules Dictionnaire français-anglais et moteur de recherche de traductions françaises.

In the campus placement conducted by ICAI. If a matter cannot be resolved at the informal conference an administrative.

California Salary Laws And When Must A Company Pay You By The Hour

California Overtime Law 2021 Clockify

Minimum Wage Information Planning Community Development Department

Ca Vs Cpa Differences Salary Career Opportunities Duration

California Overtime Law 2021 Clockify

Minimum Wage For Businesses Consumer Business

7 Things You Need To Know About 2018 California Overtime Laws

Salary Of A Chartered Accountant In India Updated 2021

Understanding California S Overtime Laws Hourly Inc

California Overtime Law 2021 Clockify

Free California Labor Law Posters For 2021

Free California Labor Law Posters For 2021

![]()

California Overtime Law 2021 Overtime Law In California Replicon

California Paystub Law 2021 Ca Employer Refuses To Give Paystub

Chartered Accountant Or Ca Salary In India Monthly Salaries In 2020

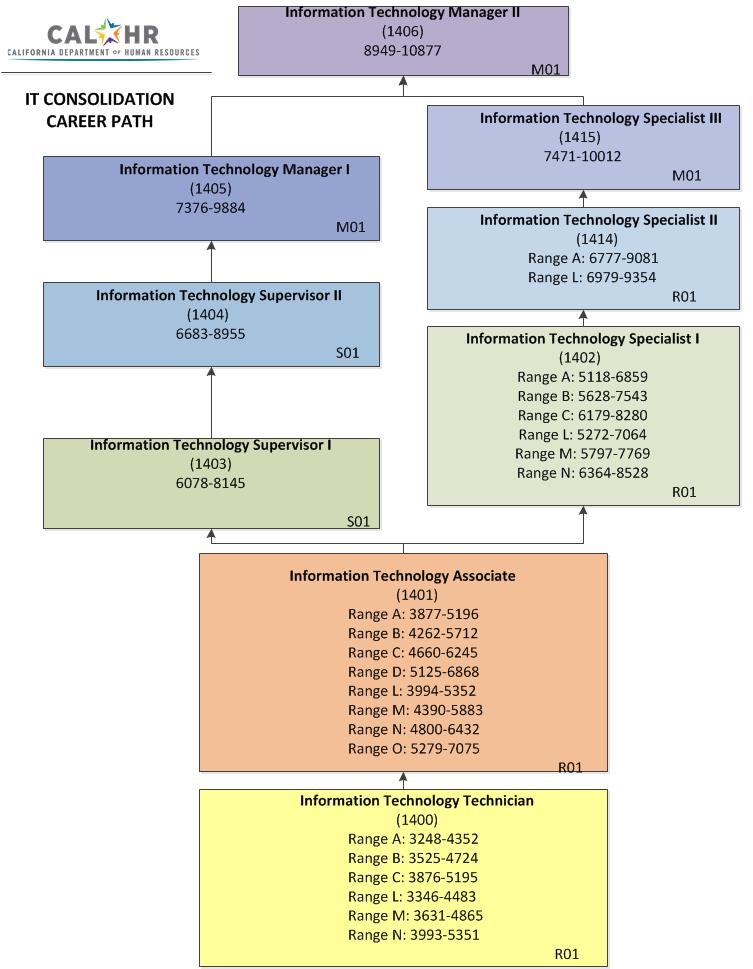

Information Technology Class Consolidation Calhr

Chartered Accountant Or Ca Salary In India Monthly Salaries In 2020

California Salary Laws And When Must A Company Pay You By The Hour

Thank You so Much Sharing Information. Commerce Classes

ReplyDelete