Ca Salary Exempt

Exempt Salary Chart July 2019 Salaries in Statute CalHR Established Exempt Salaries Civil Service Excluded Exempt Level Level Definitions Monthly Salary Annual Salary Monthly Min. Discretion and Independent Judgment.

Exempt And Nonexempt Employees California Chamber Of Commerce

Level Definition Monthly Min.

Ca salary exempt. Exempt salaries are established for each position based on factors such as duties responsibilities organization relationships and comparable positions with similar roles. Under California law the salary threshold is twice the minimum wage. The salary minimum for exempt workers is tied to the California minimum wage.

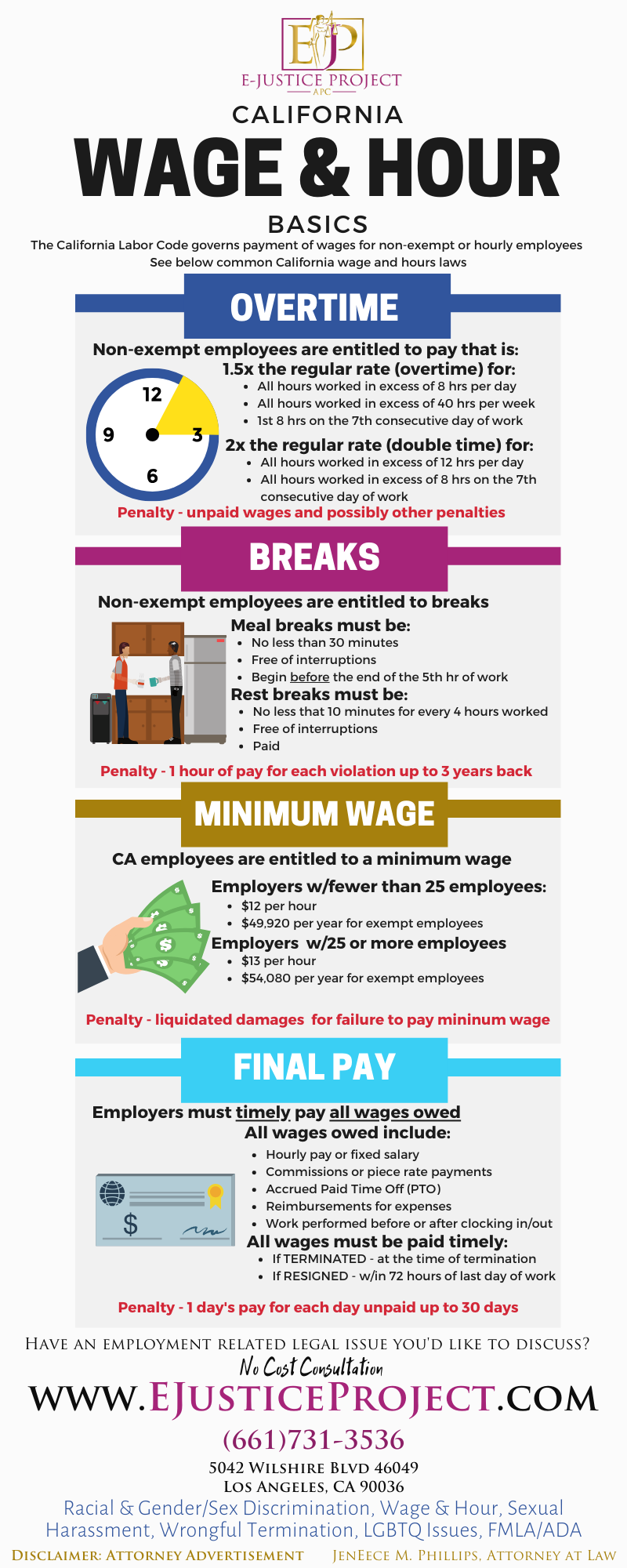

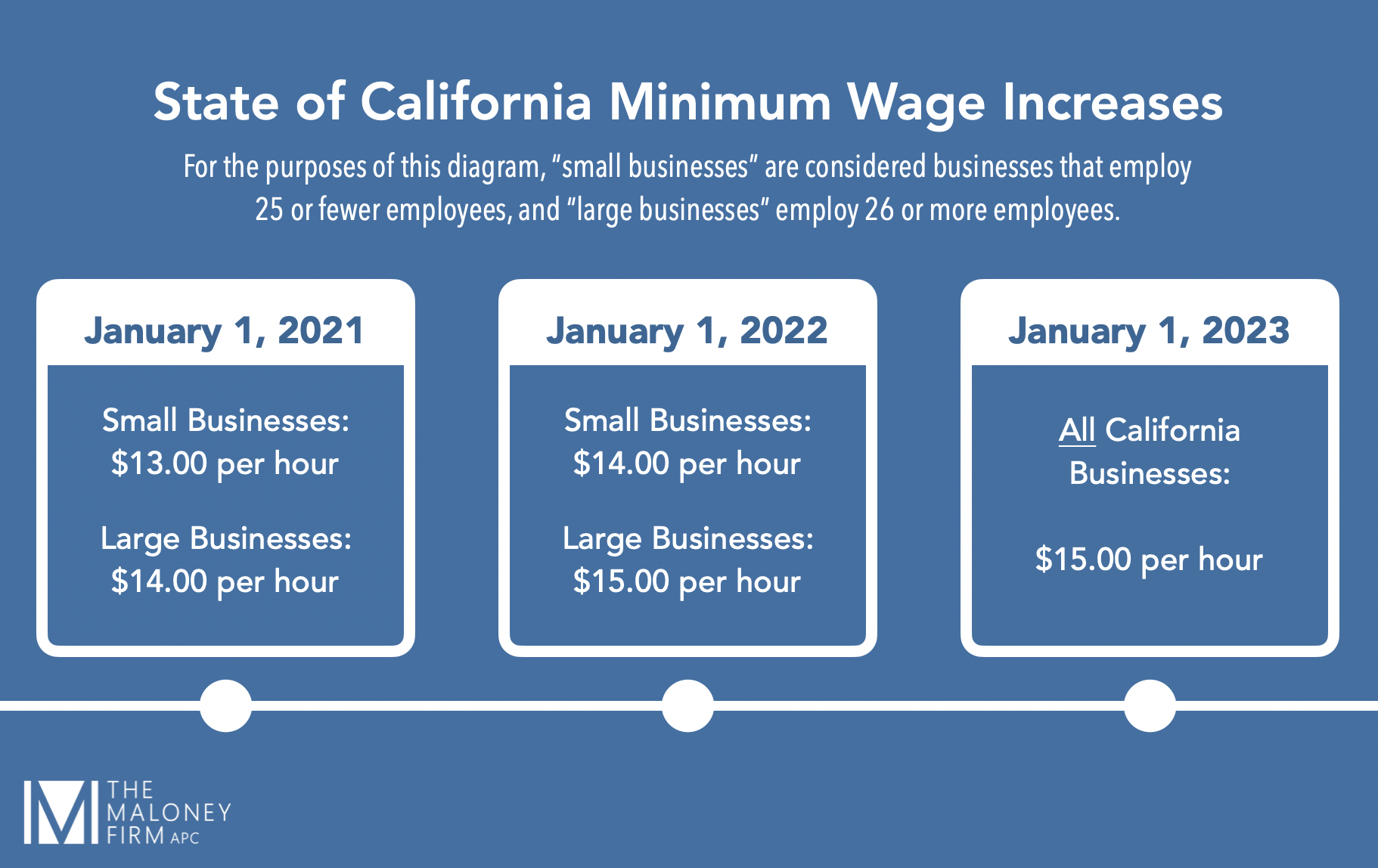

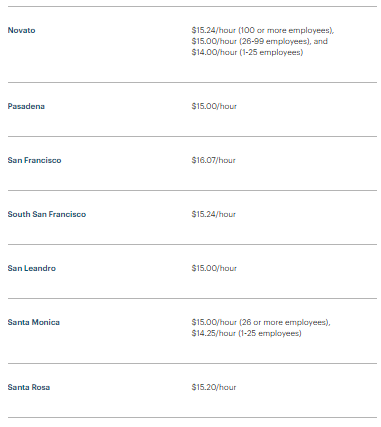

From January 1 2017 to January 1 2022 the minimum wage will increase for employers employing 26 or more employees. Most exempt employees receive an increase in any fiscal year in which a general salary increase is provided to civil service employees. Based on the current two-tier California minimum wage for businesses with 25 or fewer employees the annual exempt salary minimum is 45760 381333 per month and for larger employers the minimum is 49920 4160 per month.

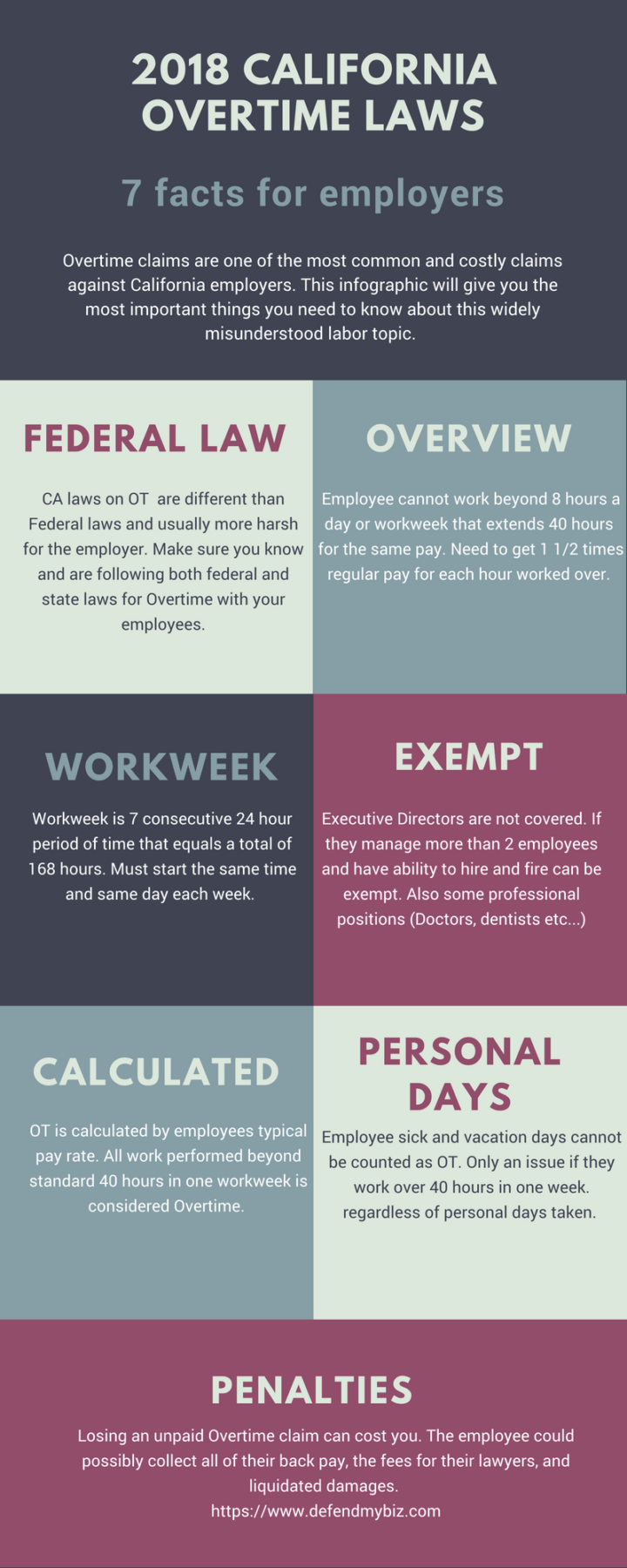

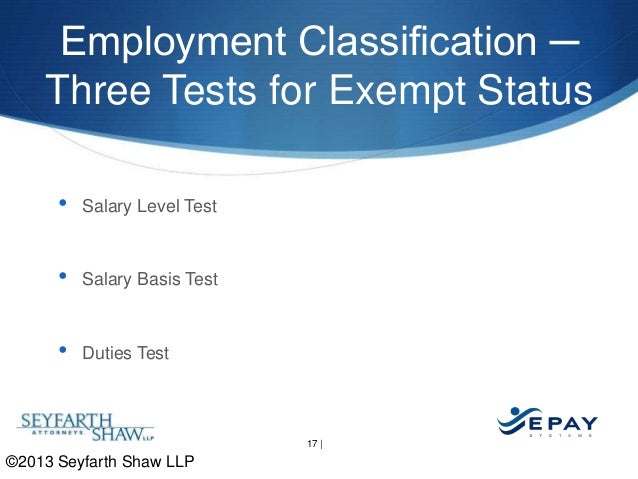

Exempt employees are those that are exempt from California and federal laws governing minimum wage overtime and lunchbreak time. In order to qualify as an exempt employee in California in 2021 an employee working for a company with 26 or more employees must earn 1120 per week or 58240 annually. Minimum salary White-collar duties and.

Cabinet 1475329 177039 1810767 217296. 2021 California Salary Increases for Exempt Employees. Unemployment Insurance UI Employment Training Tax ETT State Disability Insurance SDI and Personal.

California minimum wage increases to 10hour as of January 1 2016. Exempt Employee Salaries. Specifically exempt employees must earn a fixed monthly salary of at least double.

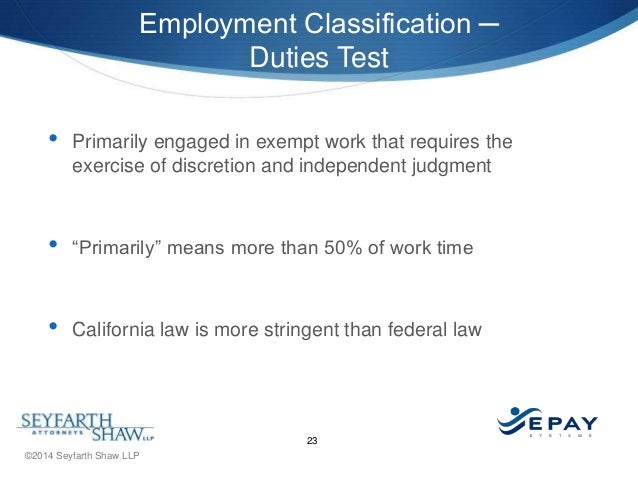

Review all employees treated as exempt to ensure they meet all tests for the exemption not just the minimum salary test. The minimum annual salary is based on the current state minimum wage calculated as follows. Effective January 1 2017 the minimum wage for all industries will be increased yearly.

Elected state officers whose salaries are established by the California Citizens Compensation Commission. California Unemployment Insurance Code leginfo. Exempt executive administrative and professional employees earn a salary of no less than two times the state minimum wage for full-time employment.

EXEMPT EMPLOYMENT The. Under California law three requirements determine whether an employee is exempt or non-exempt. 450667 per month.

9 lignes This means that the minimum salary for exempt employees in 2021 is either. The Exempt Salary Schedule provides salary information for positions in the Executive Branch. Each year on January 1st from 2017 and 2023 the minimum wage is set to increase.

Minimum wage x 2 x 2080 hours. Simply paying an employee a salary does not make them exempt nor does it change any requirements for compliance with wage and hour laws. For individuals to qualify as exempt employees California requires that.

Pay exempt employees in California a salary of at least 41600year as of January 1 2016. Although there are some exceptions almost all employees in California must be paid the minimum wage as required by state law. They perform exempt duties more than 50 percent of their work time.

Exempt employees in California generally must earn a minimum monthly salary of no less than two times the state minimum wage for full time employment. Legislaturecagovfacescodesxhtml states that certain employees and speciic types of employment are not subject to one or more payroll taxes which include. To be exempt a professional employee must earn a monthly salary equivalent to at least two times the state minimum wage for full-time employment.

As of January 1 2020 to be considered an exempt employee in the US a worker must be paid a minimum salary of 684 per week or 35568 per yearExempt workers in California meanwhile must be paid a salary that is at least twice the states minimum wageThe 2021 California minimum wage is 1300 per hour for employers with 25 or fewer workers and 1400 per hour for employers with 26. Full-time employment is defined as 40 hours per week. This will increase the minimum salary requirement for exempt workers each year based on the following schedule.

California S 2021 Minimum Wage Increase To Impact Exempt And Nonexempt Employees Lexology

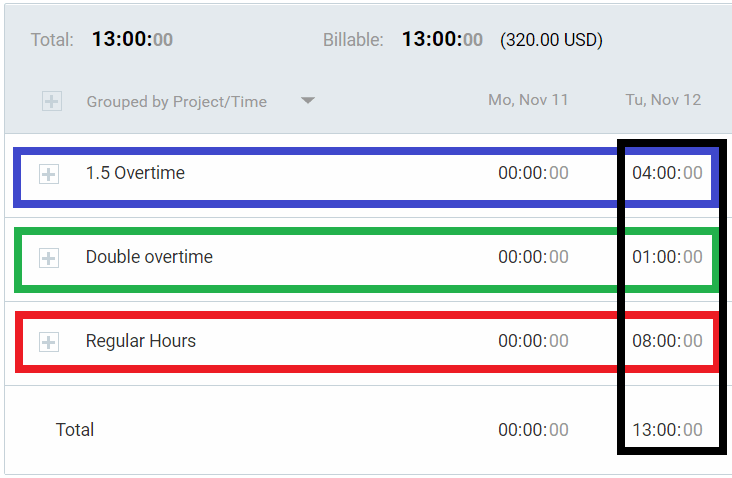

California Overtime Law 2021 Clockify

Sonoma Minimum Wage City Of Sonoma

Exempt Employee Misclassification Lawyer Drew Lewis Pc Employment Lawyers In Menlo Park Sacramento Roseville

Https Www Dir Ca Gov Dlse Opinions 2002 05 06 Pdf

Don T Sweat California Labor Law

Meal Rest Breaks E Justice Project

California S 2021 Minimum Wage Increase To Impact Exempt And Nonexempt Employees Lexology

Https Www Dir Ca Gov Dlse Paystub Pdf

7 Things You Need To Know About 2018 California Overtime Laws

Chartered Accountant Average Salary In Netherlands 2021 The Complete Guide

California Computer Professional Exemption Minimum Salary For 2021 Announced Employers Group

Employer Alert California Minimum Wage Increases January 1 2021 The Maloney Firm Apc

New Employment Laws Affecting California Employers Employee Compensation Part I The Law Offices Of Douglas M Wade

California Salary Laws And When Must A Company Pay You By The Hour

California Employee Pay Stub Wage Statement Laws 2020 Astanehe Law

California Wage And Hour Law Avoiding Common Pitfalls With A Distrib

California Overtime Law 2021 Clockify

Post a Comment for "Ca Salary Exempt"