Monthly Paycheck Calculator Missouri

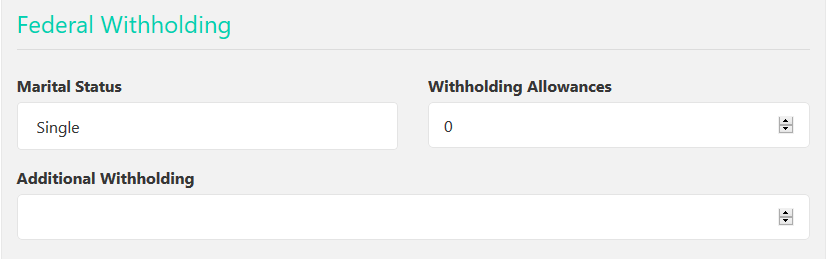

Check out our new page Tax Change to find out how. Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Missouri paycheck calculator.

Missouri Paycheck Calculator Smartasset

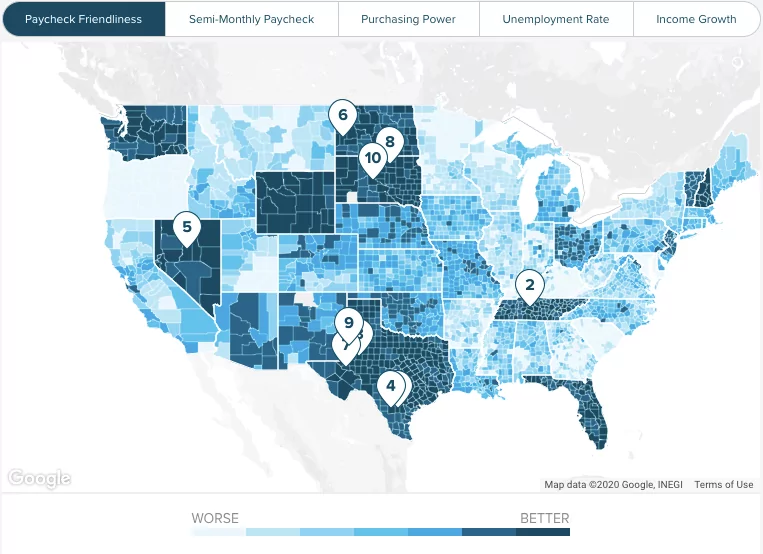

We then indexed the paycheck amount for each county to reflect the counties with the lowest withholding burden or greatest take.

Monthly paycheck calculator missouri. The Missouri Department of Revenue Online Withholding Tax Calculator is provided as a service for employees employers and tax professionals. Calculates Federal FICA Medicare and withholding taxes for all 50 states. But calculating your current weekly.

We then indexed the paycheck amount for each county to reflect the counties with the lowest withholding burden or greatest take. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. First we calculated the semi-monthly paycheck for a single individual with two personal allowances.

To better compare withholding across counties we assumed a 50000 annual income. We applied relevant deductions and exemptions before calculating income tax withholding. Missouri Hourly Paycheck Calculator.

We applied relevant deductions and exemptions before calculating income tax withholding. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Employers can use the calculator rather than manually looking up withholding tax in.

To better compare withholding across counties we assumed a 50000 annual income. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Missouri residents only. One of a suite of free online calculators provided by the team at iCalculator.

Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4. Once you start a new career or get the raise youll concur to either a good hourly wage or perhaps an annual wage. Salary Paycheck Calculator Calculate Net Income ADP.

Use this Missouri gross pay calculator to gross up wages based on net pay. Overview of Missouri Taxes Missouri has a progressive income tax rate that ranges from 0 to 540. This Missouri bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses.

See how we can help improve. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

This Missouri hourly paycheck calculator is perfect for. This free easy to use payroll calculator will calculate your take home pay. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

First we calculated the semi-monthly paycheck for a single individual with two personal allowances. Missouri Salary Paycheck Calculator Results Below are your Missouri salary paycheck results. Supports hourly salary income and multiple pay frequencies.

ZenPayroll Inc dba Gusto Gusto does not warrant promise or guarantee that the information in the Paycheck Calculator. Missouri Salary Paycheck Calculator. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

The results are broken up into three sections. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. It determines the amount of gross wages before taxes and deductions that are withheld given a specific take-home pay amount.

State Date State. It is not a substitute for the advice of an accountant or other tax professional. The Missouri Salary Calculator allows you to quickly calculate your salary after tax including Missouri State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Missouri state tax tables.

Missouri Paycheck Calculator Updated On Jul 19 2021

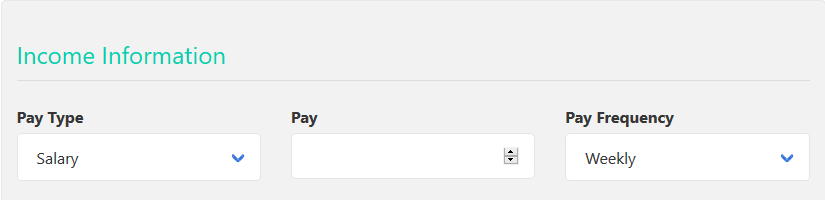

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Paycheck Calculator Hourly Salary Usa Dremployee

Missouri Income Tax Rate And Brackets H R Block

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

How Much Should I Set Aside For Taxes 1099

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Online Paycheck Calculator Calculate Take Home Pay 2021

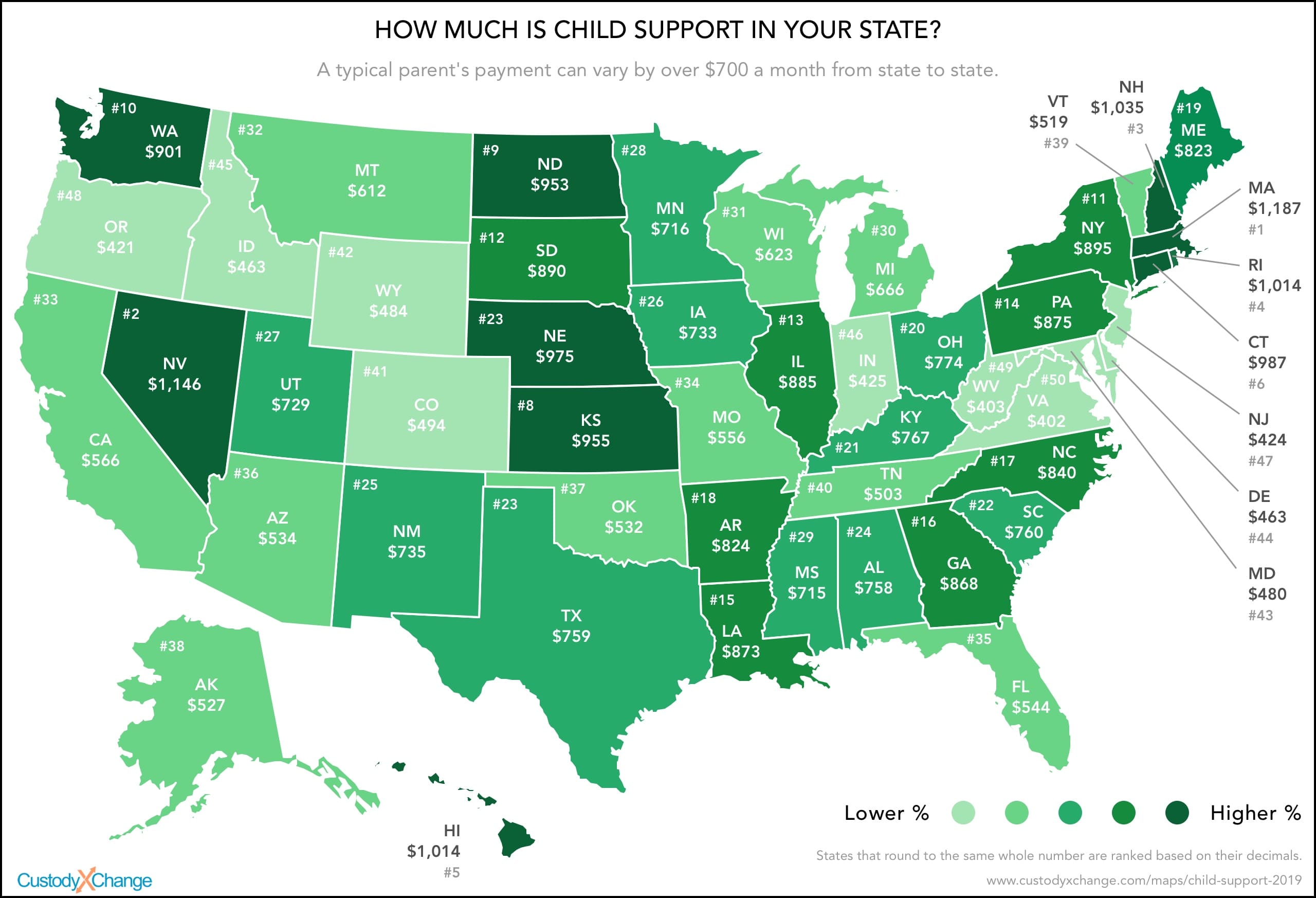

How Much Is Child Support In Your State Custody X Change

New York Paycheck Calculator Smartasset

Paycheck Calculator Salaried Employees Primepay

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Payroll Taxes

You Can Use The Above Rent Calculator To Determine The Total Cost Of Rent Per Person After Adding In Utilities And Extra Expenses For Calculator Rent Finance

Free Paycheck Calculator Hourly Salary Usa Dremployee

Paycheck Calculator For Excel Paycheck Consumer Math Salary Calculator

Missouri Paycheck Calculator Smartasset

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Paycheck Calculator Hourly Salary Usa Dremployee

How To Calculate Monthly Income From Biweekly Paychecks Includes Paycheck Calculation As Well As Two Different Ways To Budg Budgeting Budget Planning Paycheck

Post a Comment for "Monthly Paycheck Calculator Missouri"