Ca Salary Tax Calculator

To use the tax calculator enter your annual salary or the one you would like in the salary box above. Also we separately calculate the federal income taxes you will owe in the 2019 - 2020 filing season based on the Trump Tax Plan.

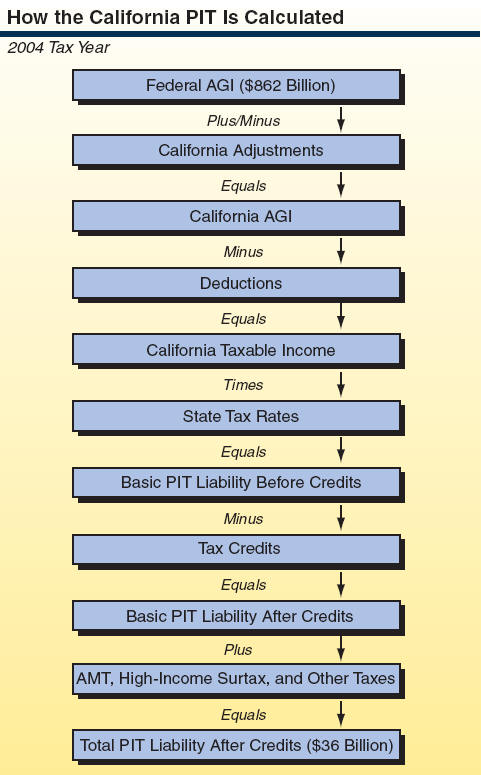

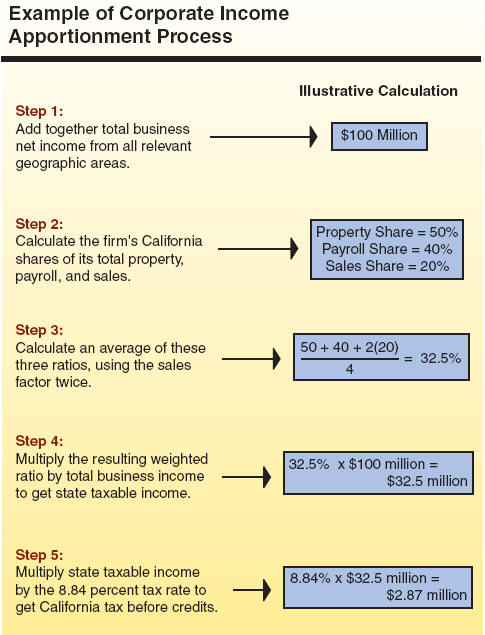

California S Tax System A Primer

This difference will be reconciled when you file your 2020 tax return.

Ca salary tax calculator. First we calculate your adjusted gross income. Your average tax rate is 221 and your marginal tax rate is 349. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by. 250000 people prefer TaxTim over eFiling. This calculator is always up to date and conforms to official Australian Tax Office rates and formulas.

TaxTim asks simple questions one-by-one then fills in your tax return for you instantly. Try out the take-home calculator choose the 202122 tax year and see how it affects your take-home pay. How Income Taxes Are Calculated.

Simple calculator for Australian income tax. If you make 55000 a year living in the region of California USA you will be taxed 12070. Check your tax code - you may be owed 1000s.

Skip the tax forms. Insert your earnings and deductions. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

Finish in 20 minutes or less. For instance an increase of 100 in your salary will be taxed 3491 hence your net pay will only increase by 6509. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income.

That means that your net pay will be 42930 per year or 3577 per month. Also known as Gross Income. Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator.

Make tax season quick and easy with TaxTim. After a few seconds you will be provided with a full breakdown of the tax you are paying. Your household income location filing status and number of personal exemptions.

Your average tax rate is 220 and your marginal tax rate is 397. New Zealands Best PAYE Calculator. This makes your total taxable income amount 27450.

If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. If you earn over 200000 youll also pay a 09 Medicare surtax. This link opens in a new window.

Enter the number of hours and the rate at which you will get paid. Marriage tax allowance Reduce tax if you wearwore a uniform. To use our California Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Uniform tax rebate Up to 2000yr free per child to help with childcare costs. Our online salary tax calculator is in line with changes announced in the 20212022 Budget Speech. Salary After Tax the money you take home after all taxes and contributions have been.

Find out the benefit of that overtime. Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year. This marginal tax rate means that your immediate additional income will be taxed at this rate.

This calculator helps you to calculate the tax you owe on your taxable income. The Salary Calculator has been updated with the latest tax rates which take effect from April 2021. If this is the case you may see a difference between your pay and the Payroll Deductions Online Calculator.

Given that the first tax bracket is 10 you will pay 10 tax on 9950 of your income. Ok thank you Please remind me. The tax is progressive five tax brackets it starts at 15 for incomes up to 49020 CAD and ends at 33 for incomes greater than 216511 CAD.

Salary Before Tax your total earnings before any taxes have been deducted. It will take between 2 and 10 minutes to use this calculator. Budget 2021-22 update This calculator has been updated with tax changes set out in the 2021-22.

KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. This comes to 995. 11 income tax and related need-to-knows.

80 of users get tax refunds - more than R300 million in refunds paid. This marginal tax rate means that your immediate additional income will be taxed at this rate. The California Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2021 and California State Income Tax Rates and Thresholds in 2021.

For example for 5. As a result your employer may be using a different Yukon Basic Personal Amount to calculate your pay. Its so easy to use.

Starting with your salary of 40000 your standard deduction of 12550 is deducted the personal exemption of 4050 is eliminated for 20182025. Use this calculator to quickly estimate how much tax you will need to pay on your income. Free tax code calculator Transfer unused allowance to your spouse.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period. Tax-free childcare Take home over 500mth.

Is calculated based on a persons gross taxable income after the non-refundable tax credits have been applied QPIP CPPQPP and EI premiums. California Salary Paycheck Calculator. Youll then get a breakdown of your total tax liability and take-home pay.

Calculate your take home pay from hourly wage or salary. It can be used for the 201314 to 202021 income.

Chartered Accountant Salary Uk Salary Tax Calculator

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Simple Tax Calculator For 2020 Cloudtax

Pin On Investing And Retirement

Paycheck Calculator Take Home Pay Calculator

Texas Paycheck Calculator Smartasset

California S Tax System A Primer

New Tax Law Take Home Pay Calculator For 75 000 Salary

How To Calculate Foreigner S Income Tax In China China Admissions

What Is Casdi Employer Guide To California State Disability Insurance Gusto

Quarterly Tax Calculator Calculate Estimated Taxes

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com

Paycheck Calculator Take Home Pay Calculator

Federal Income Tax Calculator 2020 Credit Karma

Quebec Income Calculator 2020 2021

Ca Income Tax Calculator July 2021 Incomeaftertax Com

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Ca Income Tax Calculator July 2021 Incomeaftertax Com

Post a Comment for "Ca Salary Tax Calculator"