13th Month Pay Payslip Format

You can then set them to be accessible to employees via email or print depending on your companys preferences. He has been working for 10 months in.

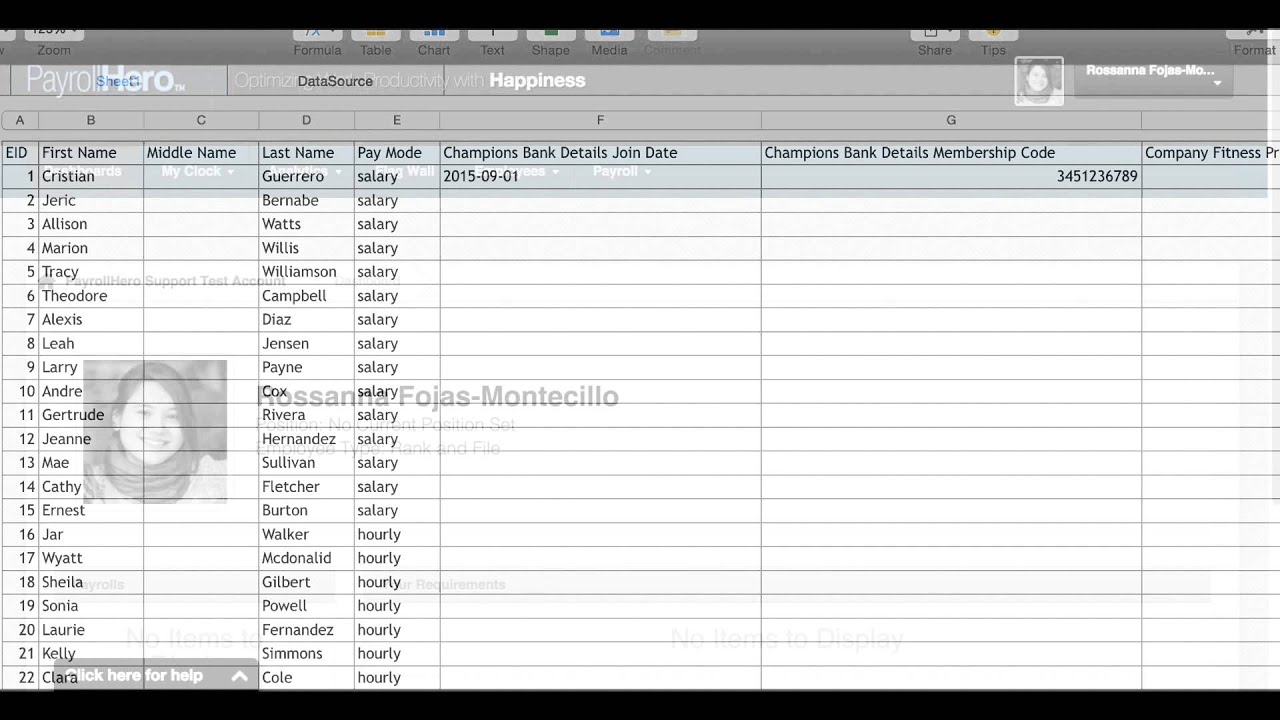

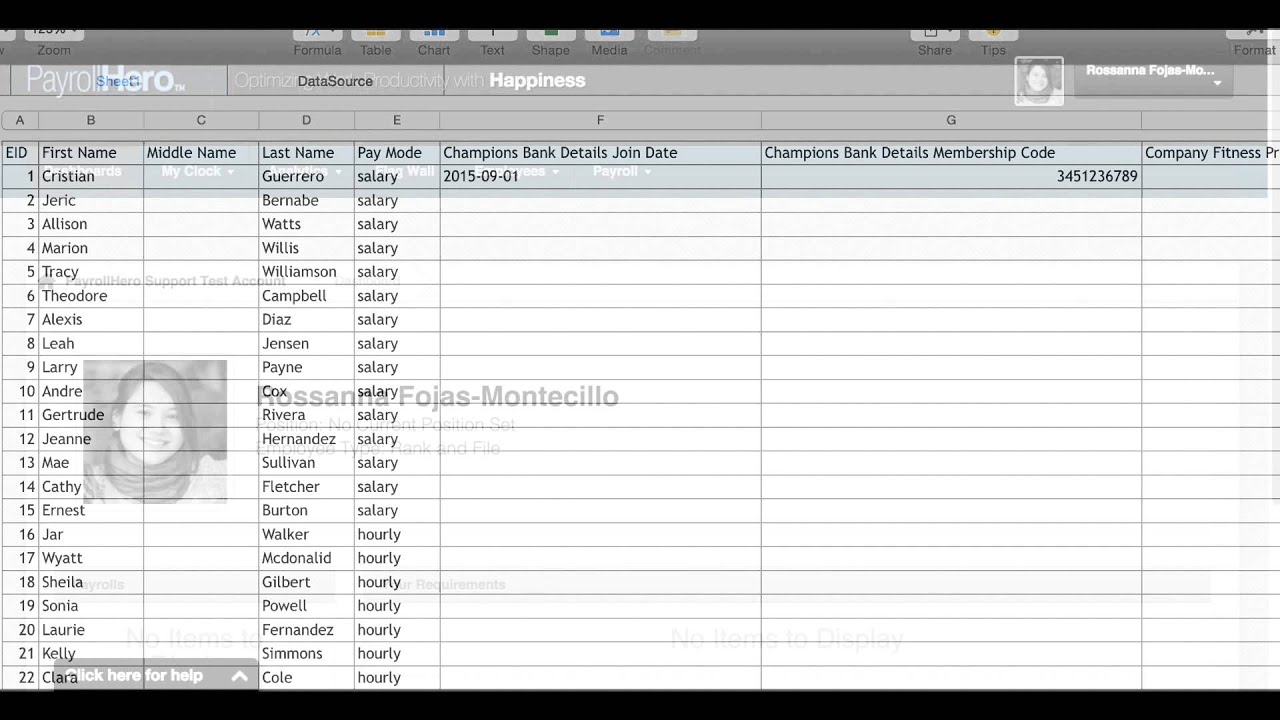

How To Generate The 13th Month Pay In Payrollhero Payrollhero Support

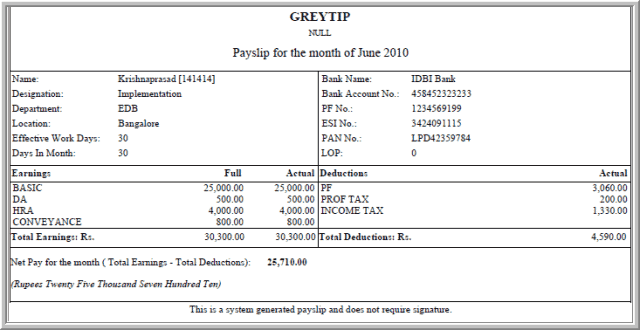

A monthly salary slip is proof of the salary an employee receives from the employer per month.

13th month pay payslip format. So PayrollHero keeps a record for every employee on how much has been accumulated for 13th Month. Paysllip helps employees to check that whether the company or employee is making payment accurately or not. It provides you a proper way and format to create payslips in a professional appearance.

If you are responsible for making of payslips for the company or business you are advised to get help from this easily editable payslip template. Essentially after a full year of work that employee is entitled to an extra full months salary. Minimum wages vary by industry and region.

Overtime Hours Worked Total Overtime Pay D Net Pay ABCDE Employers CPF Contribution. Pay Slip Sample Employer. A payslip may include name of employee total amount earned by the employee working days paid amount allowances and contribution deducted and payment date etc.

And 13th month pay in space provided. To compute your 13th month pay multiply your basic monthly salary to the number of months you have worked for the entire year then divide the result to 12 months. The basic salary amount is a very important part of.

1 Deductions for contributions to Social Security Fund. Being aware of your duty for providing pay slips to employees is an equally. These help in quick organizing as you simply dont give in time and effort to make the payslip.

Deductions from employees remuneration by employer are allowed under following circumstances Paragraph 1 Article 64. Next you should be checking in where you need to add the extra details about the company name the employees the designation etc. Your 13th month pay should be not less than 112 of the total basic salary you earned within the calendar year.

A payslip may required by a bank or any other financial organization on the time of providing loan to an employee. Monthly Payslip Template. Payslip can be a printed piece of paper or soft copy sent to the employee via email.

Apart from this the employee can apply for a loan or a mortgage using this document. You must first pick a format you like the most. Let say an employee basic salary is Php15000 per month and had worked for 10 months the 13th month computation is.

It works much like a mandatory bonus. One unique benefit to Brazilian employees is the 13th Month Salary. The payslip formats can be used in simple steps.

Please indicate amount of remuneration to be paid in patacas Paragraph 4 Article 63 in space provided. 2 Deductions prescribed by. Payslip - semi-monthly payroll period.

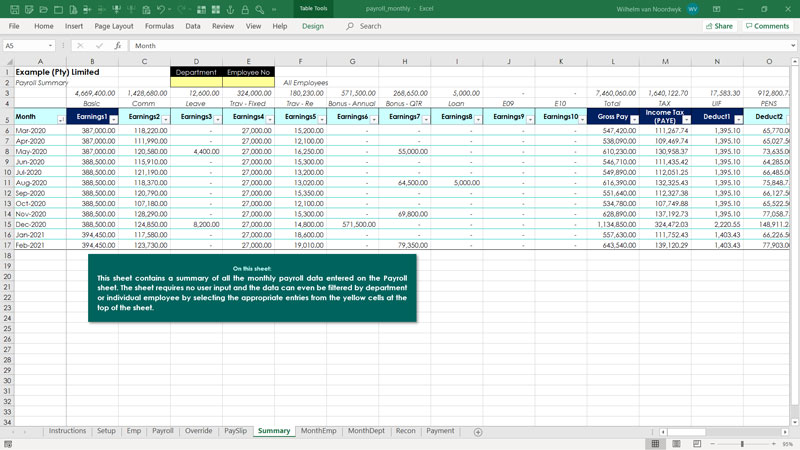

Excel format of payslip includes the formula for autopay calculations. You can add anything else that you want as per your requirements. Payslip for 1 Jan 2013 to 31 Jan 2013 Cash Cheque Bank Deposit Other Additional Payments Breakdown shown below E Total Deductions Breakdown shown below C Basic Pay A Total Allowances Breakdown shown below B Employees CPF deduction.

Others tardiness loan received by. Others company name incentive 9252009 000 000 000 000 000 000. Employees also receive overtime pay paid sick leave and vacation days.

The 13th month pay shall be in the amount not less than 112 of the total basic salary earned by the employee within the Calendar day. 9112009 to basic pay. Payslip Format for download includes all the options like Basic Pay Allowance Arrears Income Tax Van Fare Security Deposit and a deductions Section.

Total amount of benefits granted. Monthly Basic Salary x Employment Length 12 months. For example we take the sample salary slip for 15000 then the basic salary amount of the employee will be around 6000 rupees.

Finally after customization and removing any unwanted fields you can then print the formats. Theres 2 ways to finalize a payroll On the Payrolls page. The Basic salary of the employee is around 35- 50 of the total salary.

How To Pay Employees Their 13Th Month Published May 28 2021 at 1280 720 in Philippine Payslip The mesmerizing pics below is section of Philippine Payslip piece of writing which is listed within Pay Stubs Template philippine payslip template excel philippine payslip template philippine payslip and posted at May 28th 2021 165419 PM by Vlad Chan. The payslip lays out all the essential pay period information as well as tax and company-specific bonuses and deductions. On the Payrolls page Go to the Payroll tab Click on the Payrolls page Click on a.

The easy to use PDF or doc style files can be printed in one go. This means your 13th month pay is monthly basic compensation computed pro-rata according to the number of months or days you have worked in your company. Php15000 X 10 months 12 Php1250000.

The top section of this payslip includes gross pay net pay working days leaves and absents for the. Report on Compliance with PD 851 13 th Month Pay Law Name of establishment. Pasyslips are usually prepared for employees when they receive salary as direct deposit.

Paid leaves philhealth holiday pay pag-ibig net pay. All kind of employers are legally obliged to give employees an itemized payslip whenever they are paid but. A monthly payslip template comprises payment month and year and the other necessary details.

Amount granted per employee. Juan earns a basic salary at Php15000 per month at company ABC. Total number of workers benefitted.

Payslips for your employees are automatically generated after completing and finalizing your payroll. How to generate the 13th Month Pay. Make sure that employees payslip payrolls are FINALIZED.

Payslip serve employees as basic salary document to track salary payments received by the company or business for preparing. 6 Payslip templates Word Excel. Httppayrollheroph_cyoutubesupportvideo - The The 13th month pay is a Philippines mandatory bonus given to all rank and file employees regardless of t.

Here is the basic 13th month pay formula in the Philippines. However the bare minimum wage for all employees in Brazil is BRL 1039 a month. Name position and telephone number of the person giving information Ibid For more information see 13 th Month Pay.

Principal product or business. Overtime min pay adjustments amount deduction 13th month wh tax gross pay.

Hiring Remote Workers In France A Guide For Us Employers

How To Compute Your 13th Month Pay 2020 Jobs360

Hiring Remote Workers In The Philippines A Guide For Us Employers

Excel Payroll Software Template Excel Skills

Sample Undertaking To Reimburse Cost Advanced For Company Uniform Lvs Rich Publishing

10 Things You Should Know About 13th Month

How To Generate The 13th Month Pay In Payrollhero Payrollhero Support

How To Generate Payslip In Excel Format Sprout Solutions

How To Generate The 13th Month Pay In Payrollhero Payrollhero Support

Isuweldo Philippine Payroll System Philippine Payroll Solution Philippine Payroll Software Philippine Payroll

10 Payslip Templates Word Excel Pdf Formats

How To Generate The 13th Month Pay In Payrollhero Payrollhero Support

Isuweldo Philippine Payroll System Philippine Payroll Solution Philippine Payroll Software Philippine Payroll

Pinoy How How To Compute Your 13th Month Pay

Philippine Payroll How To Pay Employees Their 13th Month Pay Youtube

How To Compute 13th Month Pay In The Philippines An Ultimate Guide

10 Payslip Templates Word Excel Pdf Formats

Back Pay Computation And Guide For Working Filipinos

10 Things You Should Know About 13th Month

Post a Comment for "13th Month Pay Payslip Format"