Total Annual Gross Income For Part Time

Also pay attention to whether the issuer wants gross before taxes or net income. Median gross part-time weekly earnings for women increased by 42 per cent to 20130 while mens part-time earnings remained unchanged.

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

They can do so by multiplying their hourly wage rate by the number of hours worked in a week.

Total annual gross income for part time. In simple terms Gross Total Income is the aggregate of all your taxable receipts in the previous year. In other words what you end up taking home in your paycheck multiplied by the number of times youre paid each year. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

Age For men and women in Scotland full-time gross. The resulting number can be multiplied by 52 for the weeks in the year. I make 52000year in a southeasternish state and I dont foresee having an incredibly difficult time landing something but it has been hard to attend interviews follow up adjust my resume for each position and keep a look out for new opportunities while still working full time and managing a household.

If youre salaried you. What is her total annual income. Median gross full-time weekly earnings for women increased by 36 per cent to 51620 compared with an increase of 30 per cent for men.

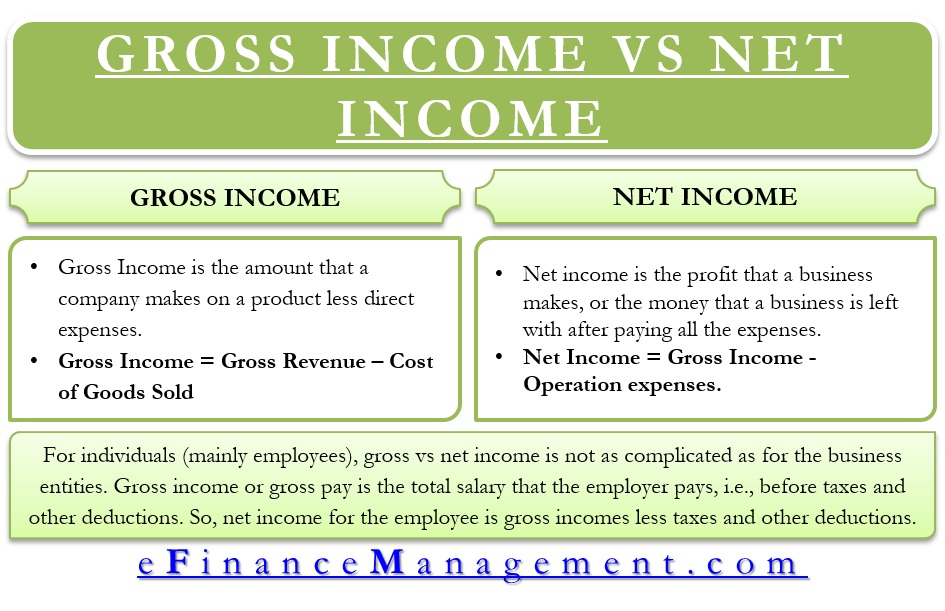

If it asks for monthly income multiply your weekly amount by 52 and then divide by 12. In our example your daily salary would be 136 17 per hour times 8 hours per day. Disposable or net income is gross income after deductions from direct taxes for example Income Tax employee National Insurance contributions and Council Tax or Northern Ireland Rates.

De très nombreux exemples de phrases traduites contenant total gross annual Dictionnaire français-anglais et moteur de recherche de traductions françaises. If your credit card application asks for your annual income and youre paid weekly multiply your weekly amount by 52. When it comes to total gross annual income youd take your hourly rate and multiply it by the hours you work per week and multiply it by 52.

Im a single mom with a busy teenage son. All bi-weekly semi-monthly monthly and quarterly figures. For an individual or business with multiple income streams or sources of earnings their total annual income will be equal to the sum of all the income sources.

How to Calculate Your Total Gross Annual Income. Your total annual income before anythings taken out. 30 8 260 - 25 56400.

Total annual income and total gross income are sometimes used interchangeably. Many translated example sentences containing total gross annual income French-English dictionary and search engine for French translations. Multiply your hourly wage by the number of work hours per day.

The adjusted annual salary can be calculated as. The category of fishing and hunting guides is not considered in this calculator as it is very specific. Gross income per month Annual salary 12 To determine gross monthly income from hourly wages individuals need to know their yearly pay.

For 2021 until september 30 2021 the province of Ontario as decided to make an increase in the minimum wage of 025 over 2020 from 14 to 1425 per hour. How to Calculate Annual Salary. They may be used during tax time or on finance applications and serve different purposes.

But will not include any deductions from section 80C to 80U. Here are the steps to calculate annual income based on an hourly wage using a 17 hourly wage working 8 hours per day 5 days a week every week as an example. For example Sarah works part-time at Online Co earning 32000 per year and also works part-time at Offline Co earning 21000 per year.

It will also include profit or loss carried forward from past years and any income after clubbing provisions. De très nombreux exemples de phrases traduites contenant total gross annual income Dictionnaire français-anglais et moteur de recherche de traductions françaises. Unless the application specifies otherwise this is usually what the issuer is looking for.

Your gross income minus taxes and other expenses like a 401k contribution. 32000 21000 53000 Total gross annual income. Gross income is obtained by adding cash benefits such as the state pension child benefit or Jobseekers Allowance to original income.

Computation Of Gross Salary Income

Difference Between Gross Income Vs Net Income Definitions Importance

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

What Is Gross Income For A Business

Salary Net Salary Gross Salary Cost To Company What Is The Difference

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Annual Income Learn How To Calculate Total Annual Income

Annual Income Learn How To Calculate Total Annual Income

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

What Is Gross Vs Net Income Definitions And How To Calculate Mbo Partners

Taxable Income Formula Examples How To Calculate Taxable Income

Gross Annual Income Calculator

Average Annual Wages France 2019 Statista

Taxable Income Formula Calculator Examples With Excel Template

Gross Net Salary The Urssaf Converter

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Post a Comment for "Total Annual Gross Income For Part Time"