Net Income Different Meaning

Net income is the residual income of the company which is left with the entity. In short gross income is an intermediate earnings figure before all expenses are included and net income is the final amount of profit or loss after all expenses are included.

Gross income and net income can mean different things depending on the situation.

Net income different meaning. You calculate it by subtracting tax expenses from an individuals gross pre-tax income. Net Sales is the amount indicating the actual sales made by the company during a period while Net income is the amount showing the actual income earned from net sales and other operations of the company. Net interest income NII is the difference between the interest income a bank earns from its lending activities and the interest it pays to depositors.

The net income is dependent on the revenue. Net income is the financial gain or loss that a business has made in one single time period while comprehensive income is the change in equity in that same time period originating in. But there are actually several different types of income in business accounting.

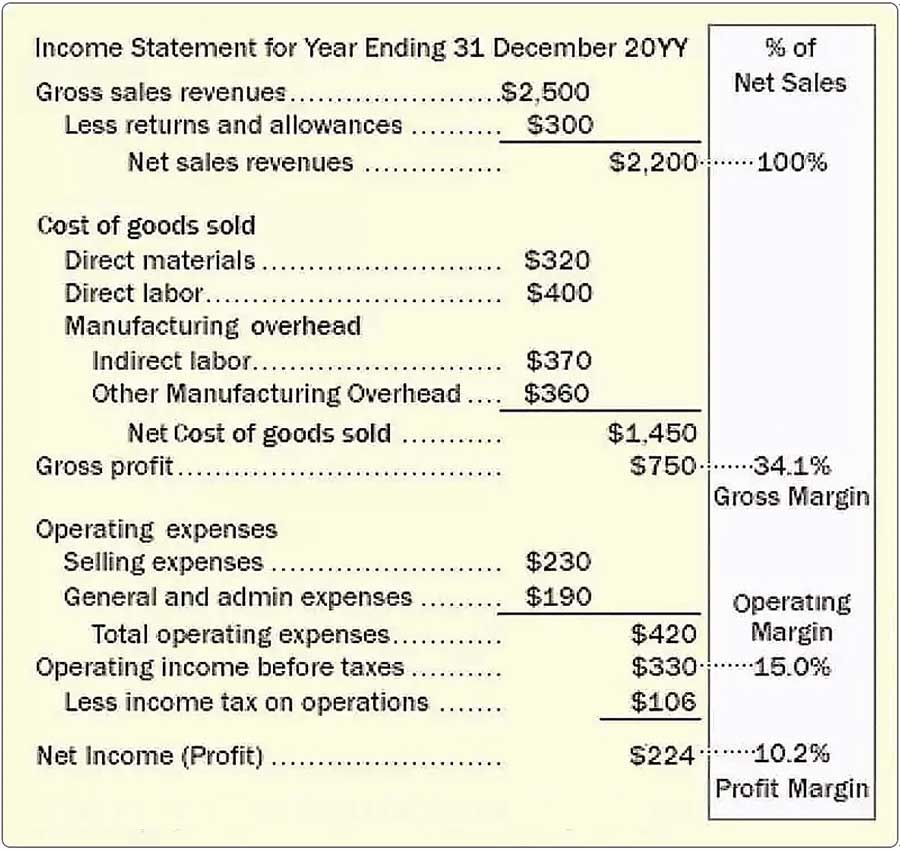

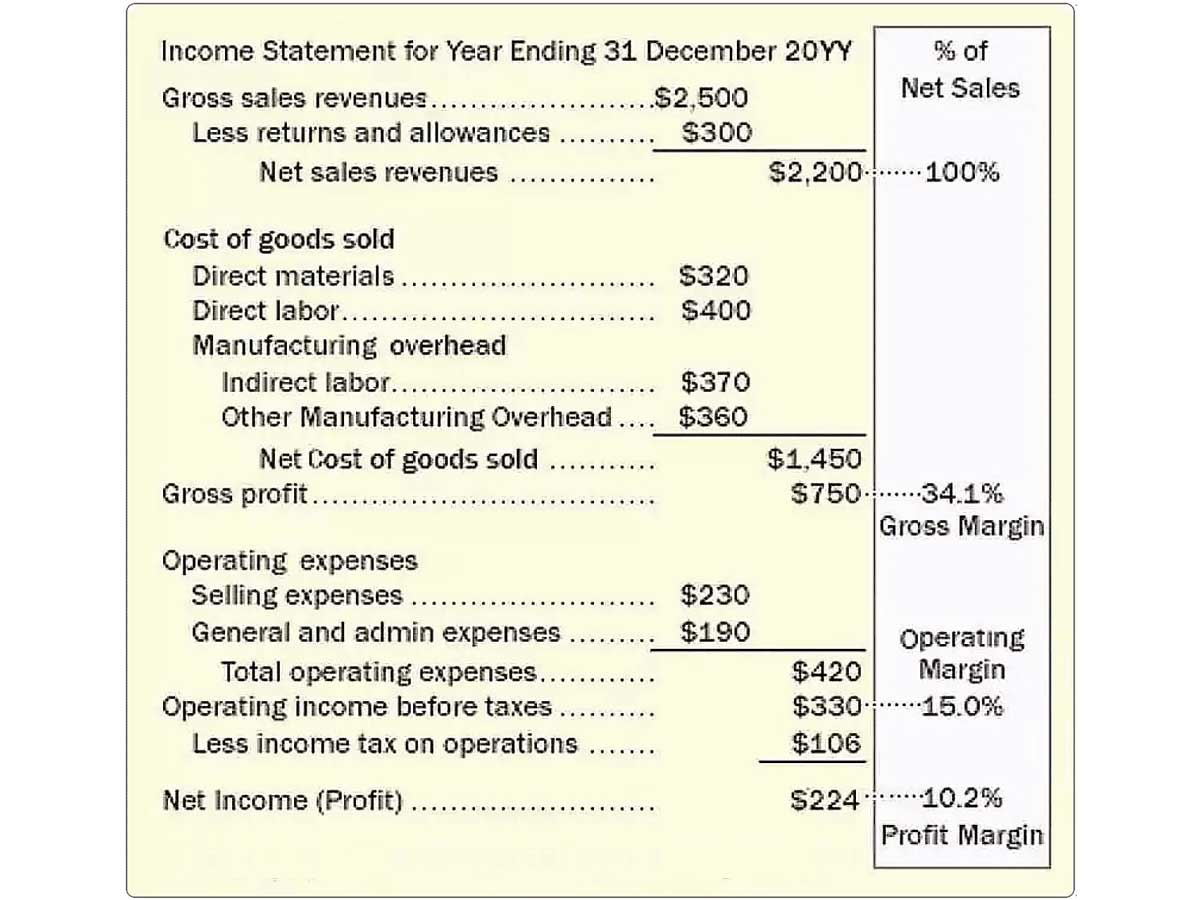

Net income for a business is income minus all expenses including taxes for. It is the last line of the income statement and often referred to as the Bottom line number. The main difference between them is which expense.

Everyone knows that for salaried persons tax is. Net income is the bottom line on a businesss income statement. The revenue isnt dependent on the net income.

On the other hand the net income is the subset of the net income. Many terms in business and finance have differing or even fluid meanings in day-to-day use. Net Sales is the major source of earning revenue whereas Net Income helps in understanding the financial health of the company.

Net income is the amount of money thats left after taxes and certain deductions are made from gross income. When we arise at the net profit preferred stock dividend is reduced from it. The remaining part is either transferred to the reserves and surplus or distributed to the equity holders in the form of a dividend or both.

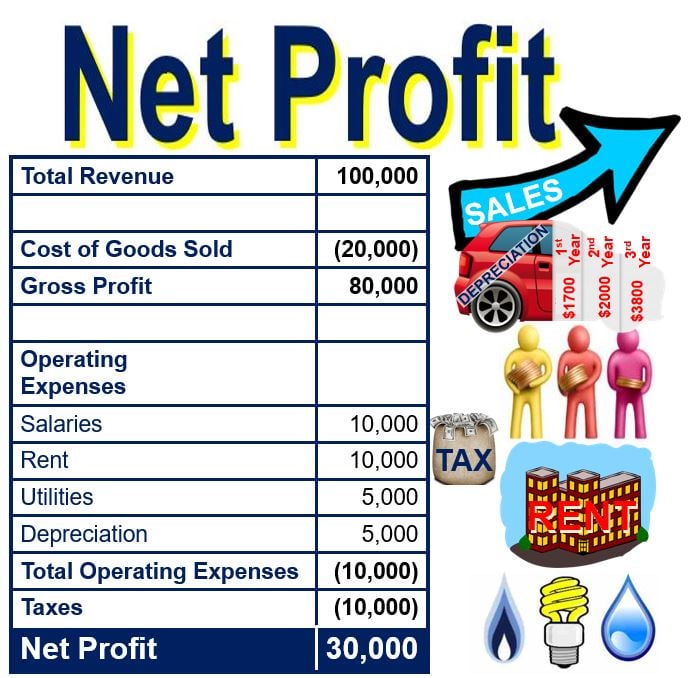

Net Income for Businesses Net income for a business represents the income remaining after subtracting the following from a companys total revenue. Net income can also be called net profit the bottom line and net earnings. When investors and analysts talk about income for a company they are usually referring to net income also termed profits or earnings.

Net Income vs. The net income is always lower than the revenue. A business has several different types of income.

Net Income is the amount left after tax and other deductions. If a company is able to steadily increase the net income of a. Thus it is also referred to as Profit after Tax PAT or Net Earnings.

Its the amount of money you have left over to pay shareholders invest in new projects or equipment pay off debts or save for future use. The key difference between EBIT vs Net Income is that EBIT refers to earnings of the business which is earned during the period without considering the interest expense and the tax expense of that period whereas Net Income refers to earnings of the business which is earned during the period after considering all the expenses incurred by the company. Some people refer to net income as net earnings net profit or the companys bottom line nicknamed from its location at the bottom of the income statement.

For example a business has sales of 1000000 cost of goods sold of 600000 and selling expenses of 250000. Net Income will always be less than the gross income. If theres no revenue there would be no net.

It is the net. It is important since it helps to calculate Earnings Per Share EPS. Net income has a similar meaning in personal finance.

Net Income is the profit remaining after all costs incurred during the period have been subtracted from sales revenue. After paying taxes the amount thats left is called net income. The term net earnings are often used many times in place of net income.

The net income is the last item on an income statement. The revenue is the superset of the net income. It is what is left of your revenue after youve covered your expenses.

Definition of Net Income. Net profit will be used to pay dividends to shareholders andor transferred to earnings reserved. In general gross income is the total income you earn on your paycheck and net income is the amount you receive after deductions are taken out.

Net of tax applies to both individuals and businesses. In other words it is the net increase in shareholders equity. Net income is the profit available for companys shareholders after the tax payment.

For a company net income is the residual amount of earnings after all expenses have been deducted from sales. Net income is your companys total profits after deducting all business expenses. The term net of tax is used primarily for specific transactions like the purchase of a building or a group of vehicles.

Net interest income Interest earned - interest paid Assuming ABC Bank earned an interest income of Rs 15000 crore on its assets comprising all kinds of loans mortgages and securities for the year ended March 31 2015 and paid Rs 13750. Net income is the same as the profit of a business or its earnings For all of these terms - profit net income or earnings - we are talking about a net amount including both the income revenue of the business and deductions to that income. An individuals gross income is the total income before taxes but net income is whats left after deductions and taxes.

Net of Tax vs. To figure out your net income subtract the cost of goods sold operating expenses interest and depreciation charges taxes and any miscellaneous expenses from your net revenue. Its gross income is 400000 and its net income.

The revenue is always more than the net income. What Is Net Income. It includes every type of income and expenses.

Operating Income Vs Gross Profit

Other Comprehensive Income Overview Examples How It Works

Https Marketbusinessnews Com Wp Content Uploads 2016 06 Net Profit Jpg

How Do Operating Income And Revenue Differ

Margins Measure Business Profitability And Reveal Leverage

Net Income The Profit Of A Business After Deducting Expenses

How Do Net Income And Operating Cash Flow Differ

How Do Earnings And Revenue Differ

Ebit Vs Operating Income What S The Difference

What Is Net Profit Definition And Examples Market Business News

Is It Possible To Have Positive Cash Flow And Negative Net Income

:max_bytes(150000):strip_icc()/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)

Gross Profit Vs Net Income What S The Difference

Margins Measure Business Profitability And Reveal Leverage

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

How Do Net Income And Operating Cash Flow Differ

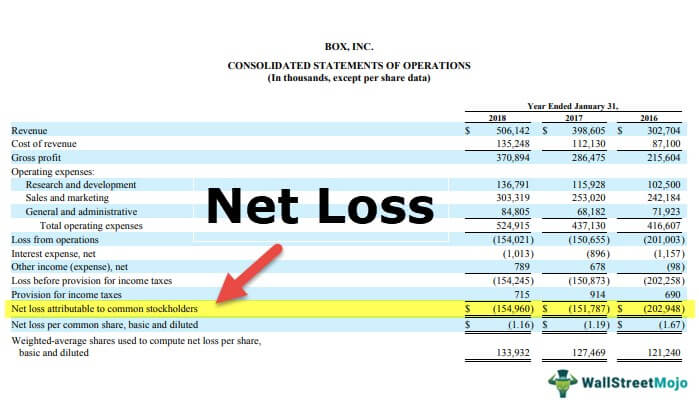

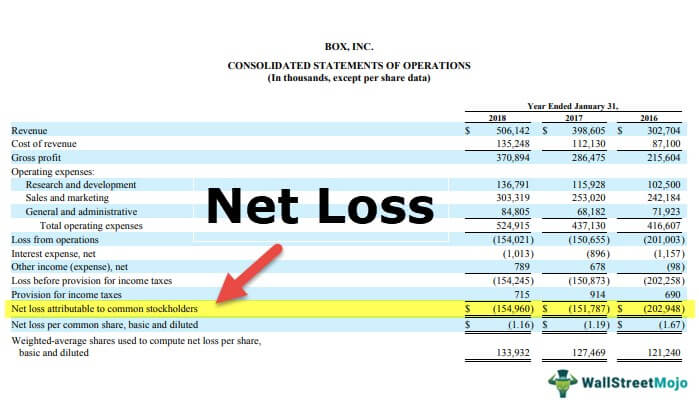

Net Loss Definition Formula Calculation Examples

How Do Earnings And Revenue Differ

How Do Earnings And Revenue Differ

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "Net Income Different Meaning"