Army Pay Tax Rate

Basic pay rate for Academy CadetsMidshipmen and ROTC membersapplicants is 115050. Soldiers pay is subject to federal income tax just like civilians pay.

40 Years Ago And Now From 70 To 30 Peak I T Rate Income Tax Rate Personal Finance

Social Security OASDI Tax.

Army pay tax rate. However for a 42-year old to replace 400K in SGLI the monthly cost is 6800 per month. Since tax laws change frequently there is no way to guarantee you will be eligible for any refund of taxes until youve had your forms reviewed by a tax professional or IRS rep. Navy to set rates and phrases of pay out for personnel on energetic duty.

And just like salaried civilians in the private sector youre not eligible for overtime pay. My civvy pay is not at the 41 rate. Medicare Hospital Insurance Tax.

Pay rates for non-commissioned members Pay rates for Regular and Reserve Force non-commissioned members NCM. Use the Military Pay Calculator to estimate military salary by rank location and the branch of service. However unlike civilians some military pay is tax exempt.

Regular Military Compensation RMC is defined as the sum of basic pay average basic allowance for housing basic allowance for subsistence and the federal income tax advantage that accrues because the allowances are not subject to federal income tax. The state also allows military personnel 55 years or older to exclude 20000 of their pay from state income tax. Your years of service and your rank which generally corresponds with your military pay grade.

In the Army youll earn a good salary from day one plus a comprehensive package that includes generous superannuation and a variety of allowances. Taxable and tax-free portions are separated for convenience. Members of the military on active duty and who are stationed in the state long enough to be considered residents are taxed at the same rate as civilians.

RMC represents a basic level of compensation which every service member receives directly or indirectly in-cash or in-kind and which is common to all military personnel based on their pay. VGLI-Rates tables are here. Establishment of Military Salary Inclusion of.

Once upon a time military bonuses that were not tax-exempt were subject to a 25 tax but later reduced to 22. Tampa rates range from 3029month for a single-member plan to 10898 for a family plan. The current rates for officers just starting out in each of these ranks are.

Nonresidents do not have to pay state income tax on their military pay but they must pay tax on nonmilitary income earned within the state. This is not the amount of tax you owe. Workplace Remuneration Arrangement 2 increas from 13 May 2021 excluding Star Ranks -.

Basic pay rates are calculated monthly rather than weekly or bimonthly and are subject to taxes like civilian pay. Things To Remember About Taxes and Military Pay. Whether youre married or single and how many dependents you claim.

OF-4 Lt Colonel ARMY. HMRCs official rate of interest for the tax year is 225. This year i have been taxed at 41 on all of my reserve pay.

Pay rates for general service officiers pilots medical dental and legal officers. Youll enjoy all this and more in the Army. Military Pay Chart After Taxes - Navy pay back charts are utilized by every one of the uniformed branches with the US.

Lively responsibility members of your navy are entitled to various shell out grades and in most cases a greater base pay. 53975 per annum Army officer pay is in line with other graduate jobs. To determine your pay rate first choose your paygrade from E-1 to E-9 and then find the row that corresponds with your number of years experience in the Army.

I thought you only got taxed on the higher rate for the amount over the threshold which i have not even reached this year. Tax laws change every year. Officer cadets at Sandhurst.

Discipline Hard conditions I Uniform The Defence Force Remuneration Tribunal approved the following changes. Knowing which pay is tax-free can help estimate income tax. The amount withheld from each check or direct deposit is based on the same basic information.

Pay estimates reflect all 6 branches of the US. FICA PERCENTAGES MAXIMUM TAXABLE WAGES AND MAXIMUM TAX Year. Great pay is just the start.

The grades include Normal flag warrant particular foundation and specialty. This benefit 562 is non-cash income and how much tax you will have to pay depends on your highest tax rate. You can also use our Army Pay Calculator to calculate pay and allowances.

Armed Forces Army Navy Air Force Marines Corps Space Force and Coast Guard and do not include Guard and Reserve Pay. Two main factors affect where you fall on the basic pay scale. Are there any Tax gurus on here that can explain why.

Army Enlisted Basic Pay Rates This pay table is used to determine the monthly basic pay for enlisted servicemembers in the Army. Maximum FICA Wages Maximum Tax. The value of the benefit is 25000 x 225 which is 562.

What you read about today may be modified eliminated or replaced by other rules. Your monthly pay is automatically.

Military Disability Compensation Rates Veterans United Network Military Disability Va Disability Disabled Veterans Benefits

Valuable Lessons From Rich Dad Poor Dad Rich Dad Poor Dad Rich Dad Personal Finance Books

Military Retirement Pay Chart 2020 Military Pay Chart Military Pay Army Pay

Military Members Hampered By Student Loan Debt Student Loans Student Loan Debt Student Loan Relief

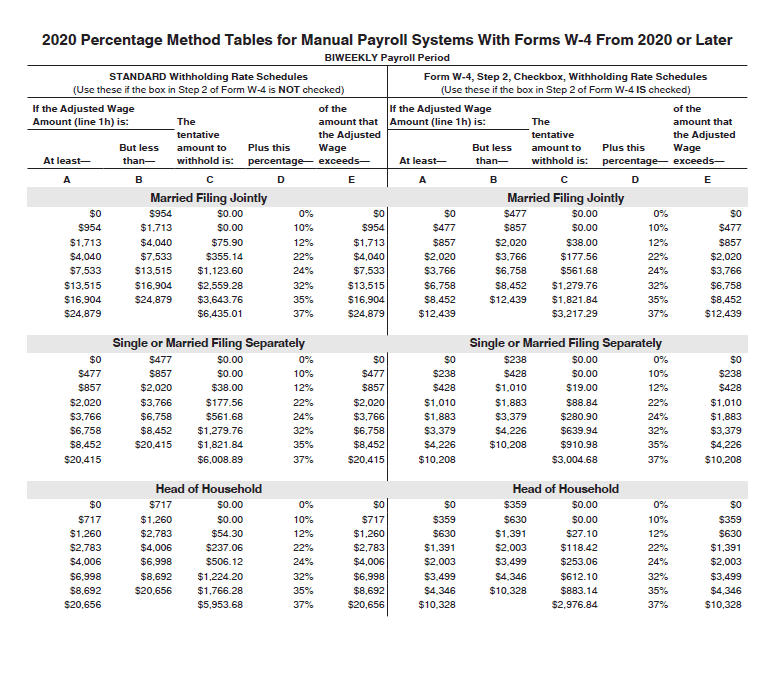

Federal Withholding Table 2021 Payroll Calendar

Income Types Not Subject To Social Security Tax Earn More Efficiently

States That Don T Tax Military Retirement Pay Military Benefits Military Retirement Military Retirement Pay Military Benefits

Indian Army Returned A Chinese Soldier Captured In Ladakh Who Accidentally Entered The Indian Borde People S Liberation Army Indian Army Army

Tax In Spain Issues You Need To Be Aware Of Axis Finance Com

Military Disability Compensation Rates Veterans United Network Army Wife Life Military Wife Military Love

Oecd Tax Database Oecd Tax Database Tax Rate

Pin By Alyssa Cazares On Navy Military Pay Chart Military Pay Paying

2021 Military Paydays With Printables Military Pay Military Spouse Blog Military

Federal Payroll Tax Form Payroll Taxes Payroll Tax Forms

Active Duty Veterans And Retired Military Personnel We Salute You We Are Proud To Offer The Saluteme Program Wit Retired Military Salute Military Personnel

Post a Comment for "Army Pay Tax Rate"